It’s the Jobs, Stupid

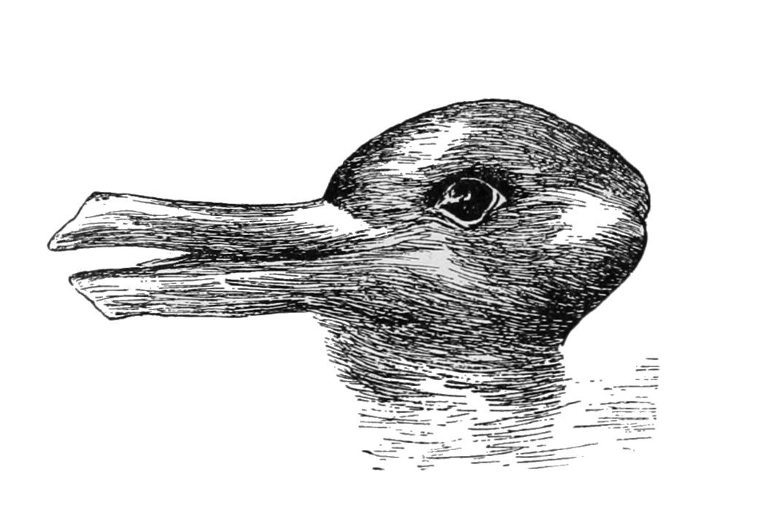

They say a picture is worth a thousand words. The thousand words of the lead image have to do with how differently Democrats and Republicans in Congress view the relationship of the current coronavirus contagion and the other great existential threat to the nation — climate change. Their opposing views are again coming into focus as debates over the next rounds of stimulus legislation break out on Capitol Hill. Their differences are as stark as that between someone sees a rabbit instead of a duck in the drawing.

Congressional Republicans, like Senate Majority Leader McConnell, and leading conservative groups like the Heartland Institute gesture to today’s empty streets, idled factories, and historically high unemployment rates, and ask Is the Coronavirus Lockdown the Future Environmentalists Want? They look up to the clearest skies in a generation — temporarily bereft of visible pollution and airplanes — and say the price is just too high!

The view across the aisle is predictably different. Congressional Democrats and climate activists point to the administration’s haphazard response to the COVID-19 contagion and the blocks-long lines at community food banks and say — this is what happens when the nation’s leaders ignore the scientists and fail to plan for existential threats! They look up at the clearest skies in a generation and advocate investing in low-carbon technologies and community resilience and adaptation measures as both the way to get America working again and rise to meet the threat of global warming.

The nation has changed dramatically because of COVID-19. How permanent a change will be measured in part by the outcomes of the 2020 elections — not just for president but members of Congress and candidates up and down state and local ballots.

This election voters will decide whether they believe the way out of the rabbit hole is back to where we were or forward to where we need to be.

Maryland’s Republican governor, Larry Hogan, writes even if regression were possible, it would be a mistake:

It’s time to acknowledge some basic truths about the crisis we are in. Reopening does not mean a return to normal.

America must get back to work, but as we do, our work — and much of our lives — will not look or feel the same. It is time to level with the country about these new realities. What does this mean? (emphasis added)

It means putting in place policies based on scientific facts rather than unfounded hunches.

Although Hogan is not explicitly speaking of the energy and environment sectors, as governor, he expressed in actions, his belief that Earth’s warming threatens the nation as surely as COVID-19. Not only does the Governor freely admit the need to address climate change, but he has also introduced a different sort of CARES Act into the Maryland legislature. Hogan’s climate bill looks to establish a 100 percent Clean and Renewable Energy Standard (CARES) for Maryland by 2040.

Democrats in Congress had hoped to include green provisions in the $2.2 trillion Coronavirus Aid, Relief and Economic Security Act (CARES Act) signed into law at the end of March. Had they succeeded, their proposals would have extended the current solar and wind tax credits, required airlines receiving assistance to offset their carbon emissions, and expanded the credits to clean energy technologies left out of an earlier enacted tax extenders package.

The depressive impact of the coronavirus pandemic on domestic and global economies and the pressure it is placing on governments to respond is as emotionally difficult to get one’s head around as it is to overstate. Beyond the health impacts of the contagion, the COVID-induced depression has shown the pre-pandemic economy to be much less secure than its stock market highs, and unemployment lows implied.

Consider that the pandemic-induced depression may claim up to half of all small businesses. A frequently referenced study by JP Morgan Chase reveals that many small enterprises carry only enough cash to survive 27 days without new money coming in the door. The numbers are even worse for small service businesses; they average only enough cushion to survive 16 days.

It is estimated that 100,000 small businesses have permanently boarded up their doors since the lockdowns began. Analysts warn this is only the beginning of the worst wave of small-business bankruptcies and closures since the Great Depression. These estimates are in keeping with a recent Gallup poll’s finding that 25 percent of all US workers fear they’ll lose their jobs because of the pandemic. If those fears become a reality, it will erase nearly all the jobs gained over the last decade.

Analysis out of the University of Chicago’s Becker Friedman Institute finds that for every ten layoffs caused by the pandemic, three new jobs will be created. The study’s authors estimate that 42 percent of recent layoffs will result in permanent job loss. (emphasis added)

The three jobs created will not be of the same level and pay grade as those lost. According to the researchers, the new jobs will be at companies like Walmart, Amazon, and Domino’s. Steven Davis, a professor of economics at the University of Chicago and one of the paper’s authors, states bluntly:

We should brace ourselves for a very long return path to the kind of unemployment rates that we had grown accustomed to as recently as January and February. We were in a great place before the pandemic hit. Unfortunately, we’re not going to get back there quickly. (emphasis added)

The energy industry has been particularly hard hit by the precipitous drop in demand due to the global lockdown, a petroleum price war between Saudi Arabia and Russia, and an oversupply of oil that’s likely to last for months.

The abrupt decline in the price of petroleum and natural gas has succeeded in sinking many small and intermediate-sized coal, natural gas, and shale oil companies. Enterprises that require $30-$50/bbl oil (or equivalent) and $2 MMBtu to stay alive are now seeing the price of petroleum about equal to that for a large pizza deluxe, i.e., between the high teens and low $20s/bbl, and $1.87 MMBtu for natural gas. A return to pre-pandemic pricing and volumes appears problematic.

Royal Dutch Shell’s CEO has told investors the company is looking at a major demand destruction that we don’t even know that it will come back. The oil price will come back, but if the volumes are significantly lower, we still have a major dislocation. Shell’s CFO is predicting an L-shaped-recovery once the virus can be controlled.

At $30 a barrel, 40 percent of oil and natural gas producers will be facing insolvency within the year, according to the Federal Reserve Bank of Kansas City.

Major oil companies are beginning to diversify their portfolios to include renewables as part of their pledges to combat climate change and to stay profitable over the next several decades. Shell, BP, and Total have announced their intentions to be net-zero emitters of greenhouse gases by 2050. Total has also announced plans to increase its stake in renewable energy projects over the next five years to 25 gigawatts.

The price of their products is hardly the sole reason coal and shale oil companies are going bankrupt. Before the first case of COVID-19 was ever recorded, some companies had taken on too much credit.

According to Bloomberg contributor Matt Levine, despite having pretty good years in 2017 and 2018, coal producers spent billions of dollars in dividends and stock buybacks to benefit their investors. They should have been stashing some of that cash for a rainy day. Now that it’s raining, some of these companies are asking to be bailed out with pandemic stimulus money. Up to $100 million in loans under the CARES Act have found their way into the coffers of these companies.

As reported in the LA Times notifications of mass layoffs at Halliburton, Apache Corp. and other energy companies have flooded the Texas Workforce Commission. Three hundred thousand jobs could be lost in the Houston area alone. It is a figure that exceeds the number of jobs lost during the entirety of the Great Recession.

President Trump claims that oil “demand is coming back” even as industry analysts predicted that global oil production could collapse by the largest amount in history in the next three months.

The Energy Information Administration estimates the oil sector won’t see a recovery before the second half of next year.

Investors on Wall Street and Main Street had already declared fossil fuels a dead-industry walking before the coronavirus crashed the economy. The pandemic is showing investors they are right to support renewables.

As reported by Bloomberg:

Even as overall demand has decreased, renewables in many countries get first priority to feed electricity into the grid. That means producers of solar, wind, and hydropower can sell all of the power they produce even as fossil-fuel generators turn down or shut off completely to prevent a system overload.

A recent study by the International Energy Agency (IEA) confirms Bloomberg’s assessment — going so far as to predict that renewables are likely the only energy sources to see any growth this year. The current issue of the Energy Information Agency’s (EIA) “Short-Term Energy Outlook” reveals that renewable energy sources will account for the largest portion of new generating capacity in 2020. EIA expects the electric power sector to add 20.4 gigawatts of new wind capacity and 12.7 gigawatts of utility-scale solar capacity in 2020 … [making] renewable energy … the fastest-growing source of electricity generation in 2020 ….

Even the Trump administration is willing to “brag” on the jobs created by solar projects. The Department of Interior just approved the largest solar energy project in the US and one of the biggest in the world. It will be built 30 miles outside of Las Vegas on federal lands. The project will produce enough to power 260,000 households, create 2000 jobs, inject $712.5 million into the local economy, and annually offset greenhouse gas emissions equal to 83,000 cars.

It is not to suggest that solar and wind companies are sailing along without a care. There are few if any winners in this time of contagion. Some solar, wind, and efficiency projects are being pushed back by months, while others have been canceled because of the historic drop in electricity demand and shuttered credit sources. Moreover, Trump’s trade war with China is disrupting supply chains and raising material prices.

The clean energy sector has not been immune to substantial job losses because of the contagion. The US clean energy sector has lost 17 percent of its workforce, or nearly 600,000 jobs, as stay-at-home orders halt production of components from solar panels to electric cars and slow installations at homes and businesses, according to a report released on May 13th. (Reuters)

Jobs lost through April are more than double the number the sector has created since 2017. Clean energy jobs have grown by over ten percent since 2015 — increasing to a total of 3.4 million by the end of 2019.

Jobs lost in the clean energy sector cut across many occupations. They include electricians, HVAC and mechanical trades technicians, and construction workers in energy efficiency; solar installers; wind industry engineers and technicians; and manufacturing workers employed by electric and other clean–vehicle manufacturing companies and suppliers. The clean energy sector employs nearly three times the workers of the fossil fuel industry. (Click here for more detail)

Although usually not counted as part of the clean energy sector, agriculture can — and should — play a major in the transition to a low-carbon energy economy and overall economic sustainability.

The past several years have been biblically brutal for American farmers. Hit first by floods, then trade wars, and now pestilence, farmers in a broad swath of the nation’s heartlands are having trouble just hanging on — emotionally and economically.

A potato farmer in Idaho told the Washington Post this year’s losses will be $3.5 million. The University of Missouri’s Food and Agricultural Research Institute estimates total farm losses this year will exceed $20 billion, while total farm debt is projected to top $425 billion. The primary source of income over the past several years for many small farmers has been the $60 billion available in combined federal aid.

Farm incomes can be increased in good times and bad through land rentals to solar and wind projects. Farmers can also support the transition to a low-carbon economy, while getting paid for their trouble, by sequestering carbon in plant matter — including trees — and building soil fertility through such practices as composting, planting cover crops, and no-till cultivation.

Carbon sequestration and sustainable agricultural practices that include water and land conservation can be monetized through direct transfer payments, tax credits, and rental fees. In addition to carbon, significant reductions in methane emissions from livestock can include the production of biofuels to run everything from a farmer’s combine to passenger and military jets.

Whatever one’s political affiliation, most agree that before the nation’s economy can heal, America must return to work. What is to be done for the seven out of ten whose jobs no longer exist? Will they be forced to compete for the three new jobs at McDonalds, Walmart, and Domino’s, or will the nation’s lawmakers find ways to help the miners, farmers, small business owners, oil patch workers, electricians, engineers, scientists, and others made redundant by the contagion to transition to 21st-century jobs?

Democratic leaders in Congress have promised programs of Rooseveltian-proportions to get the nation out of the worst economic situation since the Great Depression. The long, slow, and inconsistent economic recovery that appears before the country and the world strongly suggests such programs are needed — and soon. Congressional Republicans and the president have yet to propose any meaningful solution for putting the seven of ten Americans back to work.

Governor Hogan is right — it is time to acknowledge some basic truths about the crisis we are in. Whether rabbit or duck, the truth is the nation is facing two great existential threats. Ignoring either is done at our peril. Both, however, can be substantially lessened with overlapping policies.

We see now what happens when science is ignored and the capacity of “unseen” enemies to decimate not just the ranks of the old and communities otherwise at risk but to bring down an economy built on oil sands and the bones of creatures long extinct.

Scientists have been saying for decades that Earth’s warming threatens the health — economic and physical — of nations and, like the coronavirus, recognizes no borders. Economists and the chief executives of some of the world’s biggest oil companies are telling us in words and actions that fossil fuels hold no promise of future prosperity.

As the debates in Washington become increasingly rancorous, it is unlikely Congress and the president will come to any agreement on putting the nation back to work. It falls then to the voters to set the nation on a new course by electing leaders of either party capable of guiding us there.

In the end, we must all remember — whether duck or rabbit — we are in this together.

Lead image: Wikimedia