“Heraclitus, the inventor of the notion of the constant change of things, nevertheless set a limit to this perpetual process. This limit was symbolized by Nemesis, the goddess of moderation and implacable enemy of the immoderate.”

A story that gets repeated over and again – hubris.

Certain stories recur in the history of humanity – and one of the most dramatic and traumatic is that of hubris. Hubris is a drama brought about by actions motivated by excessive pride – for example the overestimation by leaders – and the society or institutions in their charge – of their power.

Such an overestimation leads to actions that have the exact opposite outcome to what is intended. Driven to assertions of a power that is actually more limited than they realised leaders overstep unseen limits. Assertion of power which does not exist to the extent believed reveals weakness. Some kind of fall occurs, bringing misfortune or, indeed catastrophe. It is not just the leader who is dragged into catastrophe – those they lead are too. In the terms of Greek mythology – the leader and the society following him (it usually is a him) is punished by the Goddess Nemesis.

We can see that happening now in the drive for greater geo-political power by Donald Trump – rather than accomodating the USA to inevitable decline, and taking steps to protect the most vulnerable members of society from the consequences of decline, making decline more equitable, Trump believes that he can drive American and global society in the opposite direction.

The bigger drama – the hubris of economic growth

But Donald Trump and America’s hubris is actually a sub plot in an even bigger drama – again of hubris. In the bigger drama all the major players in global geo-politics are involved. This bigger drama is one in which all the political elites, at least in the “developed” world, are effectively ignoring the limited capacity of the ecological system to carry the economic burden placed on it. This is a reference to climate change but not climate change only – there are interconnected crises of biodiversity collapse, water shortages, marine pollution from plastics and other forms of wastes, degradations of top soils, shortages of easy and cheap to access energy and other mineral resources.

Why is so little being done to address these huge threats? In large part it is because, whatever their disagreements and conflicts, all the main players in global politics share the same mind set. They have a model about human development as a continuation of the last 200 years of economic development by using more energy and resources to produce more stuff – largely through putting more energy through more efficient machinery and technical infrastructures. With this mindset there is an assumption that human ingenuity and technology can make possible continued growth of material production without ecological catastrophe because, just as there has been a technological fix for so many things before, so too there will be a technological fix for the ecological crisis.

The Belt and Road – Grand Plans of China

Thus there are many articles about the big power rivalry between, for example, China and the USA. We can read about the Chinese geo-political and economic strategy to create a trillion dollar “One Belt, One Road” infrastructural grid of pipelines, rail lines, highways, and other links of every sort across significant parts of Southeast and South Asia, as well as the former Central Asian “stans” of the Soviet Union and Iran, a future grid that’s meant to reach all the way to Europe. At the same time we can read how this is regarded with hostility by the USA which is massively expanding its military and adapting its naval strategy to respond. Yet within just a few decades sea level rise will be a threat to the naval bases of the USA and China and the cities and centres of economic power the world over.

What’s more – although some of the rivalry is about which country will have predominant access to global oil and gas supplies – the context of that rivalry is oil, gas (and coal) depletion. Because its own conventional oil supplies peaked in 2010 China is switching to unconventional oil (fracking) just as the US did but there are predictions of a peak in all oil production in China in 2020. It will rely more on imports in the 2020s. Belt and road and alliances with the “stans”, Russia and Iran makes sense in this context.

A drama within a drama – a crisis within a crisis

So there are two crises – a dangerous looming clash in great power rivalries on the one side and an economic scale overshoot of what can be taken from the planet and what the planet is capable of absorbing in the way of wastes and toxins on the other. These two kinds of crises are not independent of each other. They are very much bound up together.

This is a problem because few people in the elite are looking at the combined picture – and without seeing that bigger picture they are creating the conditions for an even bigger fall. By focusing his attention on winning the game of great power domination, on the assumption that the prize is the immense wealth and power of a technological civilisation that will be able to dominate everyone else, the leaders of the corporate world and its military industrial complex, and particularly the leaders of the USA, are preparing an immense hubristic catastrophe.

The fantasy of American energy dominance

Everything has limits – including American power. Acting as if that is not so is to prepare the punishment of Nemesis. As Donald Trump lashes out he does not strengthen the USA but accelerates the processes of its decline. This is especially the case when the strategy chosen is based on fantasies.

This is the case, for example, in Trump’s international energy policy. According to the Financial Times Trump is reported as saying: .

“The truth is we now have near limitless supplies of energy in our country,” Mr Trump said. “We are really in the driving seat, and you know what: we don’t want to let other countries take away our sovereignty, and tell us what to do, and how to do it. That’s not going to happen. With these incredible resources, my administration will seek not only the American energy independence that we’ve been looking for, for so long – but American energy dominance,” (quoted in Alastair Crooke, “What Trump’s Policy of Energy Dominance Means for the World” Strategic Culture Foundation 5th June 2018)

So here is a leader who has been completely taken in by the hype of the shale industry in the USA – who actually believes that the US has “near limitless” supplies of oil. With these immense (fantasy) resources he is going to aim for American energy dominance. Crooke explains how dominance is supposed to be achieved. Step one is for the US to use its financial market institutions to manage the trading market both in price and access – with U.S. antagonists such as Iran or Russia, being able to access the market on inferior terms, if at all. The putative ‘step two’, is to nurse US shale production, build new American LNG export terminals, and open America to further oil and gas exploration, whilst strong-arming everyone from Germany to South Korea and China, to buy American LNG exports. And ‘thirdly’, with Gulf oil exports already under the US umbrella bring Iran and Iraq to heel.…

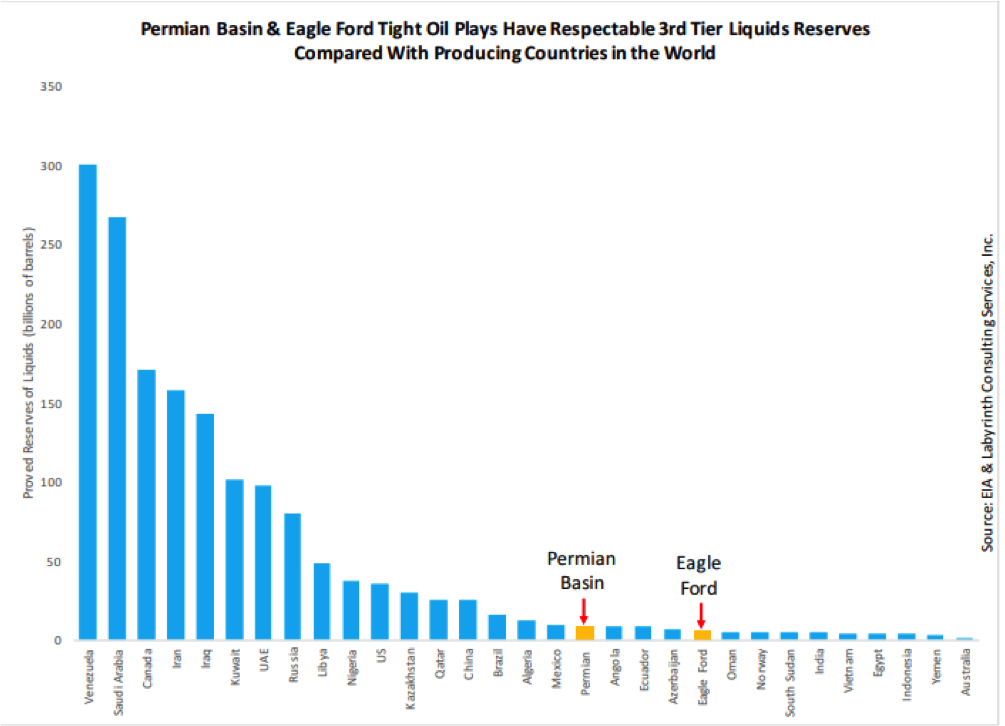

One could not get a better example of hubris – the idea that the US “has near limitless supplies of energy in our country” is a fine illustration of how a political leader can get misled by hype and their own triumphalism to utterly overestimate the potential of his (or her) own country. Consider this graph showing the areas where shale oil is booming:

Source: http://www.artberman.com/wp-content/uploads/TEC-Presentation-May-2018.pdf

A plan for global energy based on a Ponzi scheme

Of course it is true that production (a flow) has grown rapidly in the new American oil fields made possible by fracking. But a flow is not the same as a stock. Fracking technologies have improved and continue to improve at least in the sense that they speed up getting oil out of the ground – but they cannot get out what is not there – and close examination of recent oil field production increases shows that initial production increases when wells are drilled and first fracked are paid for by higher rates of depletion later. They run out quicker. So yes, the USA has rapidly built up its shale oil production in a way that has profoundly impacted the world market. But how long will it last? If we take the current rate of production in the Eagle Ford and compare it to proven reserves these reserves will be exhausted by 2025. In the Permian basin with some growth in production reserves would be exhausted in 2022. That’s what hubris is like – present power and success is no indicator of what lies in the future.

If, indeed, it is justified to write about success in the same sentence as the shale oil boom. That’s because there are other ways of measuring success than production growth – like profitability and financial stability for example. When Donald Trump shoots his mouth off about dominating the global energy market because of the limitless energy supplies of the USA he appears to be describing a future for the USA and the world based on an industry that is mostly losing money – and, to keep going, is required to borrow more and more, money that it will not be possible to repay. Using the accounts for 2017 Art Berman shows that 73% of the American tight oil exploration and production companies are losing money. This is not new – with a few exceptions most of the shale oil and gas sector have been cash flow negative since 2009.

According to Bloomberg the shale industry has been unable to fund itself whether oil is at $50 a barrel or $100.

In other words Donald Trump claims that the USA is going to dominate the world energy market with a Ponzi scheme.

The Petroyuan

You have to wonder what kind of world Donald Trump and the sycophants who surround him live in. I have examined the claim that the USA is going to be able to dominate the world because of the abundance of its energy supplies which are going to flood world energy markets – assisted by American financial institutions. Lucky for the Donald his efforts in this respect show every sign of rebounding anyway.

Not content with launching an energy offensive Donald is also intent on a trade war across all the economic sectors that have re-located from the USA, not just energy. However as this trade war with China escalates the Chinese switch from buying US shale oil to buying cheap oil from Iran:

“Iran is selling tons, literally, of its oil via the new Shanghai petroyuan futures market. Now, these aren’t exact substitutes, because the Shanghai contract is for medium-sour crude and West Texas shale oil is generally light-sweet but the point remains that the incentives would now exist for Chinese buyers to shift their buying away from the U.S. and towards producers offering substitutes at better prices. This undermines and undercuts Trump’s ‘energy dominance’ plans while also strengthening Iran’s ability to withstand new U.S. sanctions by creating more customers for its oil.” – Tom Luongo

So even before a serious fall off in oil extraction in the US the energy dominance plan is not going well – indeed trying to create it undermines remaining US power.

How to make enemies – an American trade war with the rest of the world

Nor will the broader trade war go well. Again the hubris lies in an over estimation of US power. As Nomi Prins points out:

“If you combine the economies of what might now be thought of as the G6 and add in the rest of the EU, its economic power is collectively larger than that of the United States. By alienating himself from former allies Trump is not doing himself and the USA any favours. Countries are not only retaliating with tariffs against US goods, they are re-aligning international economic relationships in a way that excludes the US.”

Nomi Prins comments on the likely effects of Trump’s trade war:

“Catalyzed by tweets, denunciations, insults, and the tariff-first shots of his administration, our allies will undoubtedly try to trade more with each other to close gaps that his trade wars open. Ultimately, that will hurt the U.S. and its workers, especially Trump’s base. For instance, German carmaker BMW, Japanese carmaker Toyota, and other foreign car companies employ 130,000 people in the United States. If, in response to new tariffs on their products, they were to begin moving their operations to France or Mexico in retaliation, it’s American workers who would lose out.”

Attacking the wrong culprits – American corporations offshored American jobs

Perhaps even more significantly, in attacking China Trump is misreading the main culprits in the relocation of America’s productive capacity to China. As Paul Craig Roberts has pointed out,

“The biggest chunk of America’s trade deficit with China is the offshored production of America’s global corporations….to put it in the most simple and clear terms, millions of Americans lost their middle class jobs not because China played unfairly, but because American corporations betrayed the American people and exported their jobs. “Making America great again” means dealing with these corporations, not with China….during the first decade of the 21st century “the US lost 54,621 factories, and manufacturing employment fell by 5 million employees. Over the decade, the number of larger factories (those employing 1,000 or more employees) declined by 40 percent. US factories employing 500-1,000 workers declined by 44 percent; those employing between 250-500 workers declined by 37 percent, and those employing between 100-250 workers shrunk by 30 percent.”

This was enormously important as a reason for the growth of US debt. It undermined the local and federal tax base, impoverished the middle class and led to a rising consumer debt – which kept demand in the US economy up but was not sustainable. With rising energy prices too the hollowed out economy crashed in 2007- 2008.

To solve that the Federal Reserve bailed out the larger banks but not consumers or ordinary people. Interest rates have been kept low which means bond prices have been kept high. Any sign that the finance markets will crash has been prevented by quantitative easing and the preparedness of other central banks to keep buying the dollar.

Rising energy costs as a source of debt and stagnating growth

This isn’t that difficult to understand if you can free your mind from the confusions of mainstream economics. All the machines and infrastructures of our techno-civilisation depend on these machines and infrastructures being powered – energy must be converted in them to do the work of manufacture, transport, communication, data processing and every other mechanised task.. Economic growth is nothing else that the result of more net energy being put through machinery and equipment as well as the result of the increasing efficiency with which that work/energy transformation can be done. (And through people too enabling them to use a part of the energy that they consume in work activities).

Economic growth in all the major economies has fallen because the net energy per capita consumed has fallen so that productivity per head has fallen. The gross energy consumed is indeed rising – but the energy used to produce energy and to fix problems produced by the energy system is rising too. For example, fracking produces energy in oil and/or gas – but it consumes prodigious quantities of energy blasting the oil and gas out of a large number of shale wells and then refining and distributing it. Renewables too use a lot of energy for a meagre energy return and require further energy consumption in extending grid connections, balancing intermittent supply and so on.

As growth rates have fallen it becomes more difficult for all companies to make a profit. Expenditure on energy is something that all – individuals, companies and states – must make. As the cost of energy rises this acts as a drag on economic growth. More companies and the banks and financial institutions supporting them struggle to survive. Indebtedness rises. The response of central banks to this has been to push down interest rates to very low or even negative levels, using quantitative easing. The central banks create money and buy government and corporate bonds.

Zombies and Junk Bonds

To solve the debt crisis of 2008 that was partly triggered when energy costs became so high that people and companies could not both serve their debts AND pay their energy bills, there has been a massive further expansion of debt.

What else would one expect in an economy and policy dominated by financial institutions? But to make this possible central banks have flooded the financial sector with more money and have driven interest rates down. This has rescued many corporations – but they have barely survived and lack all dynamism. Indeed they survive as “zombies” – only staying in business because interest rates are very low. S&P Global, a credit-rating agency, says that as of 2017, 37% of global companies were highly indebted. This is five percentage points higher than the share in 2007. Credit ratings of corporate bonds are falling. The median corporate bond is one notch above junk status. Most of the US tight oil sector of which Donald Trump is so proud can be considered as being “Zombies.”

At the same time consumer indebtness, which was about $2.5 trillion at the time of the financial crash 10 years ago, is set to reach $4 trillion by the end of 2018.

Economists who have convinced themselves that recovery has finally arrived

Now, 10 years after the 2008 crisis, central banks led by the Federal Reserve have convinced themselves that they have successfully revived the economy and are moving to raise interest rates back to what the mainstream economists think would be a more normal level. In this regard they are a bit nervous because the models are not working quite as the economists assume they should be – their models tell them at this level of unemployment the labour market should be overheating. There should be a faster rise in wages but this is not happening.

This is because the economists have ignored the way that large parts of the labour force have dropped out of even trying to look for work – the “participation rate” in the labour market has changed. It is also because many people are indeed employed but in inferior part time jobs and/or in the so called “gig economy”. If the economists were to take these into account – and the existence of many so called “zombie companies” – they would have to admit that the recovery, if that is what it is, is very weak and anaemic. What appears to mislead the economists are a variety of unsustainable bubbles in asset markets like housing, property, and equities where companies buy back shares using borrowed money. As already mentioned another bubble, indeed a Ponzi process, is the oil and gas boom in which the major companies have been losing money for years.

What keeps this bubble inflated and the anaemic recovery, such as it is, has been the low interest rates. Once interest rates rise the game will be over. Yet, convinced they are succeeding in reviving the economy after 2008 this is what the central bankers say that they are now aiming for with a policy of “quantitative tightening”. Instead of creating money to buy debt instruments and pushing down the costs of borrowing they now intend to do the reverse – selling the bonds on their books and driving up the costs of borrowing, while reducing the money supply. (Because a payment to a central bank effectively cancels out the money paid to it).

Trump’s military expenditure as a bomb under credit markets

Whatever…the central bankers and their economic advisers have convinced themselves that the recovery is solid enough to push interest rates back up. Unfortunately they are doing this at a time when Trump management of government finances looks set to give interest rates an even greater upwards shove. The combined effect may serve to put a bomb under a US and global economy.

As if things were not worse enough already, Trump, acting like the sorcerer’s apprentice, is heavy handedly trying to push other countries around. But they are now pushing back. Just at the time when the USA wants to borrow more, countries are not only not prepared to lend any more to the US, they are dumping US Treasuries. Why should they lend the USA government the money that allows the US to try to bully them? It is true that countries like China are cautious about doing this as it would mean a write down of the value of their vast dollar holdings in the USA but there will be a limit to China’s patience. Instead of lending dollars back to the US countries like China and Russia are converting them to gold.

If making America great means wilfully ignoring limits then that is what the latest US budget does. It features tax cuts for the rich – combined with a massive increase in military spending – even more than the Pentagon asked for. There was $700 billion for the Pentagon and related programmes in 2018 and $716 billion for 2019. The annual increase by itself is bigger than the annual defense budget of Russia ($61 billion) and the two-year jump of over $165 billion eclipses the entire defense budget of China ($150 billion).

For the forseeable future in the USA the fiscal deficit – the excess of spending over taxation revenues – will be enormous and growing. Under current arrangements that will mean something like 5% of US GDP will be borrowed by the US government – and this is not mainly to produce productive assets or to repair bridges and decaying civilian infrastructure but to produce weapons.

International bankers regard Trump as reckless

In a 25th June article about the Annual Report of the central bankers bank, the Bank for International Settlements, Ambrose Pritchard Evans of the Daily Telegraph explains how the BIS are worried about the level of global debt and what rising interest rates could do.

“While the report is careful not to single out the US, the central bank fraternity views Donald Trump’s unfunded tax cuts and higher spending as reckless. The stimulus will force the US Federal Reserve to raise interest rates faster, and out of step with Europe and Asia. This risks a spike in the dollar, which in turn threatens to topple the vast edifice of dollar denominated debt outside US jurisdiction.” (Daily Telegraph 25th June 2018).

As regards the latter point I am aware that modern money theorists point out that governments that issue their own money supply do not have to borrow anything. They can simply print money and spend it into existence. If there is spare capacity in the economy government spending into the economy will not, in theory, be inflationary because that unused capacity will be put to work without any upward bidding of the general price level. However that is not the way that it is done at the moment – the finance sector is set up to make it possible for the finance sector to extract a rent based on their credit creation.

And China?

In this essay I have said that there is a hubris in the global elite in general and not just in America. So what about China? Its belt and road strategy is one of great ambition for the integration and development of Eurasia as a whole – but it too depends on energy and material resources for its delivery. The Belt and Road will enable China to access the energy resources of central Asia, of Russia and of countries like Iran but these too are in decline. When the rude awakening comes about the limits of America’s very temporary oil renaissance, a clash with the USA could happen.

Analyst Nafeez Ahmed points out how openly available US Army documents show that the real interests driving US military strategy toward Russia includes dominating oil pipeline routes and accessing the vast natural resources of Central Asia. That means that the US is not just in conflict with Russia but in its involvement in the central Asian “stans” – including Afghanistan – it is seeking to insert itself along the route of the Belt and Road.

Ahmed quotes:

“Vast reserves of oil and natural gas in and around the Caspian Sea were the primary source of the US’s initial interest in the region. That interest could provide the foundation for stronger ties between the US and regional states, with the US providing protection to ensure regional stability and the political independence of the littoral countries.” (p.8)

So there we have it – the Americans want to “provide protection” to ensure “regional stability” and “political independence” along the path of the new Silk Road….

In conclusion

Trump is on the attack “to make America great again” – but his attack is based on resources that America does not have in energy; it involves picking a fight with countries that, when combined, have more power than the US, it is aimed at the wrong actors and is likely to badly rebound on the USA – but also on the rest of the world.

In this respect if we study real life stories of hubris, it is not just the out of touch leader that is brought down by their fantasies of omnipotence. They bring their own societies down too – and can wreak havoc on the rest of the world. The US economy has been hollowed out by its own corporate elite and loaded down with debt by a predatory financial oligarchy. Its oil and gas production boom is very temporary as American reserves are actually very small.

When this truth is clear for all to see, as will happen at some point, the USA will still have the most powerful military machine that has existed in all of history and in whatever catastrophe it finds itself we should not expect that the American elite will go quietly into decline without rage that other powers are undermining what they see as their self evident future, what they think of with a strong sense of entitlement and of manifest destiny. In this regard they will convince themselves that they are the good guys – probably defending central Asia or somewhere else from predatory power.

Quite apart from the danger of climate change and ecological collapse there is a very real danger of nuclear war.

Featured image: Nemesis, by Alfred Rethel (1837)