Are you wishing you could be at Davos, Switzerland this week, taking in the stimulating and deeply insightful discussions on the theme “The Fourth Industrial Revolution”? If so, reading the pre-conference book of the same name may leave you reassured that you aren’t actually missing much.

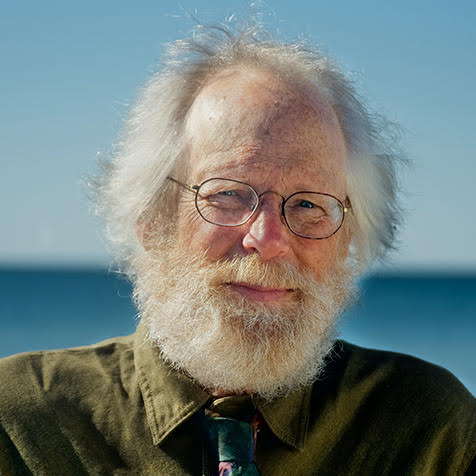

Klaus Schwab, founder and executive chairman of the World Economic Forum, released his Kindle book The Fourth Industrial Revolution just a few days ago, providing a free copy to Davos attendees. (That way they needn’t stretch their expense accounts to cover the $9.91 Kindle fee that the rest of us must pay.)

Schwab has doctorates in economics and engineering, plus a master’s in public administration from Harvard. And he says that The Fourth Industrial Revolution is “a crowd-sourced book, the product of the collective enlightened wisdom of the Forum’s communities.” If credentials alone would create a good book, this would be a humdinger.

What is the Fourth Industrial Revolution? In Schwab’s words,

"today we are at the beginning of a fourth industrial revolution. It began at the turn of this century and builds on the digital revolution. It is characterized by a much more ubiquitous and mobile internet, by smaller and more powerful sensors that have become cheaper, and by artificial intelligence and machine learning."

Elsewhere he also throws genetic engineering and the editing of genomes into the mix.

While noting that billions of people have yet to “fully experience” the second and third industrial revolutions, Schwab believes that “the fourth industrial revolution will be every bit as powerful, impactful and historically important as the previous three.” In his view it’s not just likely but inevitable that “major technological innovations are on the brink of fuelling momentous change throughout the world.”

Inevitable? Can we be perfectly confident that we’ll have plenty of affordable energy to power communications among trillions (literally trillions, in Schwab’s vision) of internet-connected sensors in the “Internet of Things”? Will our new fleet of self-driving cars have plenty of fuel to keep us moving en masse in individual pods?

All recently discovered fossil fuel deposits cost more to extract than the market will currently pay. And international banksters can’t get economic growth moving lately no matter how much extra money they print.

While the uncertainty of our long-term energy supply doesn’t even rate a mention in Schwab’s account, he does pause to worry a bit about the slowdown in economic growth.

A key problem for the future, he says, is that economic growth will remain slow, unless the inevitably arriving technological revolution finally produces a commensurate improvement in productivity. Alas, he says, the recent lack of productivity growth “is one of today’s great economic enigmas … for which there is no satisfactory explanation.” (But students of energy economics will note that the years of reduced productivity cited by Klaus correspond neatly with a steady decline in energy return on investment (EROI).)

Likewise, Schwab sees increasing economic inequality as potentially ominous, though he doesn’t suggest anything to ameliorate the trends. It’s possible that large numbers of blue-collar workers will lose their jobs to robots, and white-collar employees will be replaced by artificially intelligent algorithms. The growth of “the human cloud” may end regular employment, with pensions and benefits, in favor of ad hoc tasks assigned by websites.

So will a dire employment outlook be part of the new technological future? Klaus says “The choice of ours” – but he doesn’t say who is included in the “we” and “ours” of that choice. “It entirely depends on the policy and institutional decisions we make”, he says, and then exhibits a distinct “free market” bias when he adds “a regulatory backlash could happen, thereby reasserting the power of policymakers in the process and straining the adaptive forces of a complex system.” (Yes, the dreaded regulation. The Guardian reports this week that in a survey of chief executives by PricewaterhouseCoopers, over-regulation topped all worries.)

While Schwab fears that government might over-regulate business, he is also concerned that government may lose some power to regulate the public. “Growing citizen empowerment … could result in political systems that make governing more difficult.” As marvelous as computer technology may be, “The digital age undermined many of the barriers that used to protect public authority, rendering governments much less efficient or effective as the governed, or the public, became better informed and increasingly demanding in their expectations.”

While the ongoing technology revolution may have the unfortunate side-effect of empowering citizens, Klaus shows no such misgivings about how technology empowers us as consumers.

The consumer seems to be gaining the most. The fourth industrial revolution has made possible new products and services that increase at virtually no cost the efficiency of our personal lives as consumers. … The benefits of technology for all of us who consume are incontrovertible.

Left unanswered is just how we’ll find the cash for this “efficiency of our personal lives as consumers”, once robots and algorithms have taken our jobs.

One last thing. If you’re concerned that climate change might be a downer in our future, perhaps Schwab will allay your fears. The phrase “climate change” appears only once in the book, and Schwab turns away worries about carbon emissions and resource depletion with this paean to new (and as yet uninvented) technologies:

The fourth industrial revolution will enable firms to extend the use-cycle of assets and resources, increase their utilization and create cascades that recover and repurpose materials and energy for further uses, lowering emissions and resource loads in the process. In this revolutionary new industrial system, carbon dioxide turns from a greenhouse pollutant into an asset, and the economics of carbon capture and storage move from being cost as well as pollution sinks to becoming profitable carbon-capture and use-production facilities.

If you’re not content to take that on faith, then this book may not be for you.