Warn anyone in the USA about the coming energy crisis and you’re likely to see eyes roll. “What energy crisis? That was half a century ago! Markets and technology won. Today we’re back among the top oil suppliers!”

All true, but the response gives a false sense of security that has policymakers and publics sleepwalking toward a cliff. An energy crisis is likely ahead, no matter our rank (currently third) among oil supplying nations. Seeing the coming crisis requires looking beneath the veneer of oil supply claims and asking some deeper questions.

The issue of energy scarcity is important because energy, fossil or otherwise, is tightly tied to economic output. A prolonged energy crisis—one in which substitutes for scarce energy are too expensive, environmentally harmful, or beyond humanity’s technological capabilities—would likely put an end to growth of industrial economies. While degrowth to a steady state economy is what steady staters seek, a lengthy and substantial period of degrowth would be a nightmarish outcome that would produce unnecessary suffering and conflict.

Revisiting an Energy Price Shock

Fifteen years ago, the world suffered an economic downturn that required intervention by central banks and governments to prevent a depression-level economic collapse. Economies in much of the world had been expanding since 2001, but deregulation of mortgage lending produced a bubble that sent shockwaves through the global financial and economic system. This much is well understood, but what is little recognized is the pin that burst the bubble. The pin was the price of oil, which doubled between 2007 and 2008.

Oil prices rose because world petroleum output could not keep up with demand. Because oil is a “master resource” used for energy or as a feedstock in practically every economic sector, rising prices caused the global economy to slow. The over-leveraged housing industry, already vulnerable because of a lack of credit-worthiness of some buyers, began to unravel. And although government intervention has been extensive, GDP growth after the 2008 crisis remained tepid.

But the economy recovered as energy extraction picked up, underlining the critical importance of energy to the economy. With higher oil prices and a period of low interest rates, extraction relying on a new technology—fracking—was added to the oil industry’s toolbox. Fracking increased oil supply by opening access to so-called “light tight oil” from mid-continental U.S. shale deposits. This period of increased supply is known as the “shale boom.” It made the USA a major supplier, and concerns about energy supply slid into the rear-view mirror. Indeed, headlines about ”Peak Oil” that were common before the Great Recession of 2008-09 soon disappeared as fracking opened up supply.

The last decade, however, has brought new attention to the limits of energy availability and has shown that the shale boom may be short-lived. Because of oil producer obfuscation (particularly on the part of OPEC) we are still unsure of total global oil reserves, and by a terminological sleight of hand (described below), what was once considered oil has changed meaning, adding to confusion about reserve totals.

An Accounting Problem

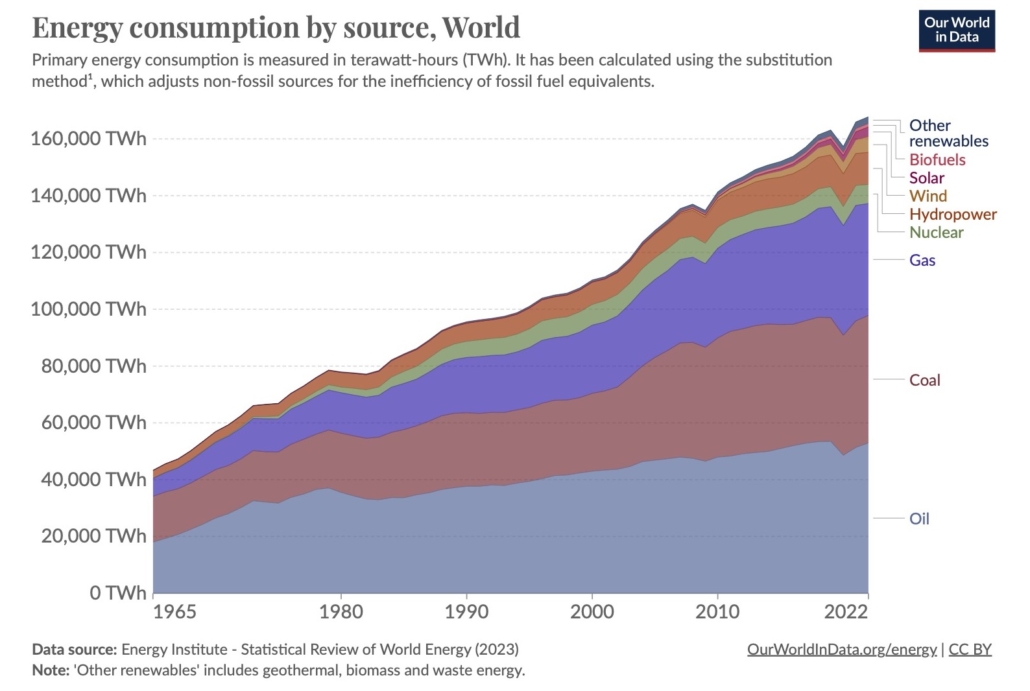

Oil accounts for about 40 percent of total global energy consumption. Given its critical importance to economies worldwide, you’d think estimates of the remaining stocks of oil would be a settled matter. Yet experts have offered a wide range of estimates for decades. Determining the remaining recoverable reserves of countries and of the world is difficult for several reasons.

First is a lack of transparency; producers are reluctant to disclose the extent of their assets, or they wish to exaggerate them for greater global influence. Oil analysts have been suspicious of some producer claims for many years. A recent analysis suggests that OPEC reserves are overstated by 300 Gb (billion barrels), and FSU reserves by 100 Gb. (The reduction in OPEC reserves would align with the long-held theory to explain the “mystery” of sudden reserve additions in the 1980’s—the additions were likely a maneuver to increase export quotas.)

Fossil fuels continue to dwarf renewable sources. (Our World in Data)

Another problem in counting oil reserves results from conflating heavy oils with conventional oil. Heavy oil resources are plentiful, but less economically useful than conventional oil, and extracting them is economically (and environmentally) costly and difficult to scale up. Yet heavy oils are counted in production as though they were equivalent in quality and accessibility to conventional oil. In fact, because they are harder to extract, their “flow rate” is limited and they cannot provide significant spare capacity in times of need.

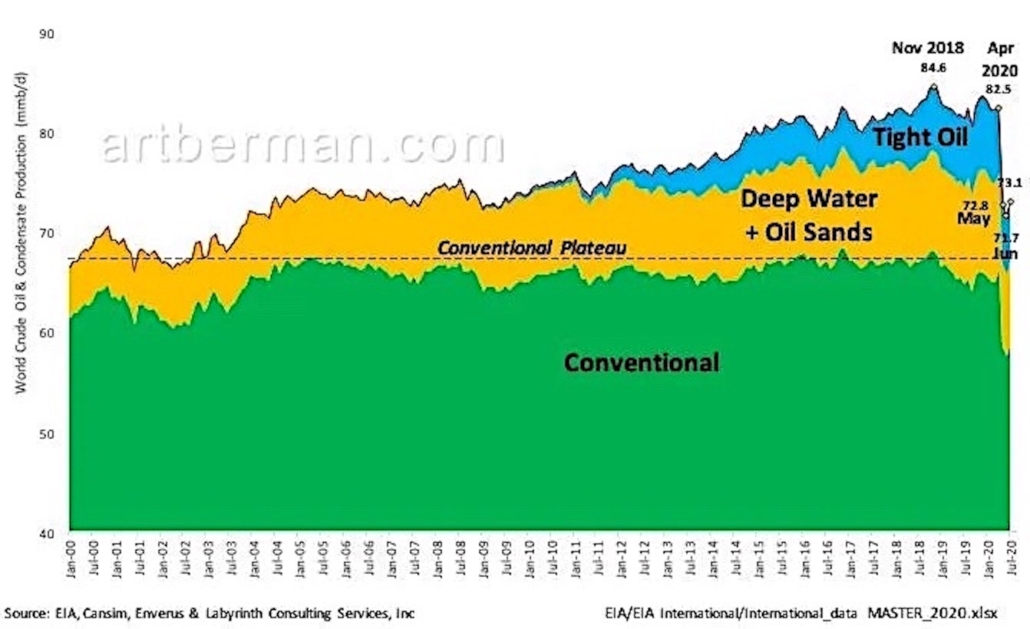

Shale oil also complicates the oil accounting question. The USA is endowed with the best oil shale deposits (for oil production) on the planet and has more than doubled its production over the past ten years. This output has boosted all-liquids fossil fuels production and helps to explain how world demand has been met over the last decade. As seen in the figure, conventional oil has plateaued. Nearly all new additions to consumption have come from U.S. tight (shale) oil.

Shale oil is beset by several problems, however. One is the daunting and capital-intensive nature of the extraction process. Unlike extraction in conventional fields, fracking shale for oil is a constant effort involving drilling down one to three miles, then laterally for miles more before hydraulically fracturing the shale (injecting fluids under tremendous pressure containing large quantities of sand to keep the fractures open), and finally, pumping the liberated oil out of the deposit. This must be done continually to exploit a field.

A second problem with shale is the nature of the “oil” produced. Analysis by petroleum geologist Art Berman indicates that fully 30 percent of reported oil production in the USA, much of it from shale, is natural gas liquids—light hydrocarbons that have significantly less energy content than conventional crude. The light grade of oil is not suitable for heavy transport that relies on diesel. So, much of the fracked shale oil produced by the USA cannot be used in the country and must be exported, so it does not contribute to U.S. energy supplies.

Growth in U.S. oil production since around 2005 has come from hard-to-get sources (blue and yellow). (Art Berman).

The other problem for shale is the spectacular decline rate of a typical well. A conventional well may have a decline rate of 6 percent per year after peaking, but fracked wells plummet dramatically from the start, with a decline rate of 60 percent in the first year and 25 percent the second.

This means that companies need to drill new wells continually just to maintain production at a constant level. This is “The Red Queen” predicament, after Lewis Carroll’s “Through the Looking Glass,” in which the Queen advises Alice to run as fast as possible just to stay in place. It’s a very apt metaphor for fracking.

If world oil demand continues to increase as expected by energy advisory bodies such as the International Energy Agency and the U.S. Energy Information Agency, fracked deposits will have to perform increasingly well in the years to come. Yet production at two of the major oil shale plays—the Eagle Ford in 2013 and the Bakken in 2020—has apparently peaked, leaving only the Permian Basin as a prospect for expansion.

In sum, given the plateauing of conventional oil, the likely exaggeration of some countries’ reserve levels, and the rapid decline of fracking as a strategy for boosting conventional output, a peak in total liquids should be of urgent concern to policymakers and the public.

The Net Energy Cliff

The lengths humans will go to extract oil illustrates its value as an energy source. Gone are the days when an explorer could stick a pipe in the ground and hit a “gusher.” Today we drill miles deep in the ocean, mine dirty oil sands, and crack open deep rock (fracking) to find oil. But these increasingly extreme measures themselves require increasing inputs of energy.

This raises a key question: How much energy is being expended to get various forms of energy? What is the energy cost of energy production? Analysts studying the question developed the concept of “energy return on energy invested,” or EROEI, to answer this question. The measure expresses the energy in the extracted resource compared to the energy cost of its exploration and development.

The Net Energy Cliff. (Adapted from Wikipedia)

For example, extraction of 50 units of energy in oil (as in historic oil and gas fields) may require one unit of energy, for an EROEI of 50 to 1. But over time, as oil extraction requires increasing effort, oil’s EROEI might fall to 30 to 1, then 15 to 1. Declining EROI is precisely what characterizes the current state of fossil hydrocarbon extraction, as the graphic shows.

The implications are staggering. A declining EROEI reveals that extraction of energy will be increasingly expensive and eventually, cost-prohibitive. Hydrocarbons will still be in the ground, but the costs of their extraction will continue to climb. This also means that, barring the development of some new type of energy source, society will have to adapt to a much lower energy future. And it suggests that the monetary costs of extraction will erode GDP growth and eventually cap economic expansion.

Action is Needed Now

In 2005, just a few years before the rising price of oil triggered the 2008 economic crisis, the U.S. Department of Energy commissioned a report from the think tank SAIC titled “Peaking of World Oil Production: Impacts, Mitigation and Risk Management.” It’s clear from interviews that the authors were shocked by the implications of soon-to-arrive global Peak Oil, which they termed “an unprecedented risk management problem.” Analyzing the supply and demand side of the oil scarcity challenge, they concluded that at least a decade, and more likely two, would be needed to prepare for Peak Oil and prevent social and economic upheaval.

The report garnered a great deal of attention at the time, as did other warnings of energy limits. But the subsequent “shale revolution” changed everything. Instead of being recognized as a last domain of exploration and recovery, the media framed shale and fracking as an energy elixir. The intervening years have not produced the preparatory planning that Hirsch warned should occur.

Perhaps a peak visible on the horizon will draw attention to the predicament we are in: Perpetual economic growth cannot be reconciled with energy limits. The longer we wait to act, the higher the cliff, the more painful the landing, and the more difficult the transition to a steady state economy. Some local communities have been planning for energy scarcity, and I will share their work of conservation and adaptation in a future post.