Climate&Economy.com is a punchy roundup of news. Focusing each alternate day on one of its titular subjects (excluding Sundays), the blog is a vital resource for anyone studying either sector.

Every day’s post is a collection of dozens of articles, with a short excerpt, explainer, and link to each — and occasionally a pithy comment by the blogs anonymous author. Given the breakneck speed of climate and economic turbidity, this rapid-fire platform is just about the only way to stay up to date with the headline news on both.

Its stated aim, to unify the blinkered, siloed perspective of mainstream news into a coherent picture, adds another layer of value to Climate&Economy.com:

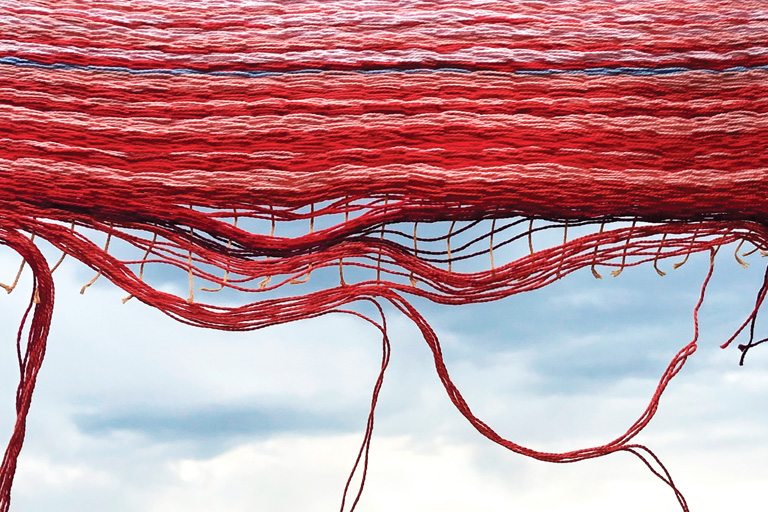

“By cobbling together a daily patchwork quilt of stories from the mainstream press I gained an overview that was more than the sum of its parts. In a sense I hijack mainstream, fairly middle of the road publications to tell a story that none of them individually are capable of telling or willing to tell.”

The news offered doesn’t come from unusual sources, but simply scours the world’s top news sites and scientific blogs. Reading these sources alone, stories of climate disaster or economic breakdown are overshadowed by stories of a less integral nature — whether political gossip or local interest stories.

When combined, however, patterns emerge. This year’s wildfires in Greece might be devastating, even exceptional, but alone they could be just an anomaly. When you combine them with exceptional fires in Canada and Siberia, alongside the collapse of Antarctic sea ice levels, city destroying floods, and temperatures not seen in 100,000 years, the pattern becomes clear. The world is dangerously overheated. Certainties are breaking down and a new, unstable Earth is emerging.

There is a similar pattern in the blogs economics sections. Crises, some long running, and some borne out of recent events, are converging to create increasing instability. Read individually, these stories seem disconnected. Protectionism in one nation, decline in one sector — alone these are just the punctuation marks of normal economic history. Occurring together and alongside a laundry list of similar phenomena, it becomes obvious our globalised economy is having a globalised crisis.

A New Pattern

Recently however, another pattern has been emerging on Climate&Economy.com. Whilst both of the blog’s categories have differing focuses, they seem to be merging.

The lines between economic and climate chaos are blurring, morphing into a singular, chaotic, and ill-defined category that subsumes both.

“The warning signs of another 2008-scale financial crisis are flashing red” warns Senator Sheldon Whitehouse in one post “and behind them looms the collapse of Earth’s natural systems”.

He is not alone is thinking this. In a recent Financial Times piece featured on Climate&Economy.com, Economist Vinod Thomas outlines this point even more explicitly:

“Climate damages are translating into billions of dollars of unpriced losses globally, rendering shocks to a shaky system.”

System Shocks

Stories of skyrocketing food prices could be found in either category on Climate&Economy.com. Economic disruption driven by exceptional droughts likewise blur the barrier between them. In recent Chinese heatwaves, factories grew too hot to work within — and were unable to be cooled by AC because water levels were too low for hydropower plants to function.

China’s June-July heatwave alone wiped an estimated 1.3% off of the country’s GDP. An estimate including the years full gamut of climate extremes — floods, crop failures, and typhoons — would certainly be higher.

Climate is not always the causative factor in this blurry relationship. As economic disruption convulses Germany, its coal usage has surged. Similarly in the UK, with a floundering economy as his casus belli, Rishi Sunak has promised to “max out” the nations North Sea oil and gas reserves. In the US financial sector, a backlash against climate-aligned investment funds has led to a 39% decline in green bond issuance.

Perhaps the starkest example is the recent failures by the UK government to secure contractors for new offshore windfarms. The auction garnered no bids, with potential contractors citing inflation driving operating costs beyond what the was on offer. Much of this shortfall in renewable capacity will be filled by fossil gas, darkening the nations already bleak net zero prospects. The functioning of the global economy has always been the primary driver of climate breakdown, but now economic tumult is derailing its spluttering transition.

A Fraying Future

This merging of economic and climatic woes is likely to worsen. As economic malaise prevents economic transition, and climate chaos inflicts physical damage on economies, the two will feed into each other.

Opportunistic demagogues, both private and public sector, will emerge to claim the generalised chaos makes it too expensive to transition. Rent-seekers will swallow ailing capital, extracting wealth that could otherwise be invested into retrofitting, adaptation, and mitigation. Supply chains shocks, whether the drought-constrained Panama Canal or rice export bans, will accelerate deglobalization — cutting off foreign investment just as its need is acute.

States, both north and south, will continue to atrophy. Granting fractions of their sovereign domains to private and foreign interests who, in an environment of such uncertainty and volatility (both physical and economic), will seek quick plunder over long-term investment. Examples already exist. Liberia is set to concede a full 10% of its national territory to a UAE firm for carbon offsetting. A deal that will provide quick wealth in desperate circumstances but erode the nation’s economic and territorial integrity.

False Benignity

It is the auxiliary sectors of the financial economy that have been the first to recognise their fate is tied to the climate. Whilst asset managers crash ahead, making billions even as the economy shudders; actuaries, insurers, and pension funds are sounding the alarm.

The society of actuaries has recently rebuked the fantastically benign scenarios most investment models rely on. Instead, pointing out that on current climate trajectories, there is a strong potential for 50% GDP loss by 2070. Insurers and reinsurers are planning to abandon entire regions as sea level rise, wildfire, and flooding makes payouts impossible. They have not been quiet in communicating the threat. The Association of British Insurers have “…long been calling [on government] for more robust planning policy… increasing our resilience to climate related risk.” Yet few are listening.

The Convergence

This unification of the economy and climate (as well as the wider biosphere) is one of the planets greatest threats. Yet it is also its only potential for survival. All capital is climate capital now. All investment is climate investment. It is now only a question of whether it is investment in further chaos or its resolution. Government spending is vital to initiating a wider economic shift, whether they choose to follow a model of public ownership, or a hybrid transition in partnership with a (necessarily tamed) private sector.

Comparisons of economic climate action to “hair shirts”, or as being opposed to “future prosperity” are harmful delusions in this respect. There is no longer an offset between ecological sustainability and economic prosperity, they are (and always have been) firmly intertwined. We are merely waking up to this fact.

True, the choice of who suffers or benefits is still a political choice, but the physical space to contest this material distribution is shrinking. At a minimum, we must align the signifiers of economic success with known ecological indicators — and this is just the first step on a long, complex realignment. If we fail to undertake this journey, we will be stuck paying for our own apocalypse.