Biden’s new plan to cancel student debt is a major movement victory, but there’s much more to be done for those hardest hit by the crisis.

Following over a decade of activism against the United States’ massive student debt crisis, President Biden announced a plan on Wednesday to cancel a significant amount of student loan debt for tens of millions of low and middle-income Americans.

Many organizers, whose work made the announcement possible, have viewed the news as a major victory for their movement. However, they also see it as just a small first step in a country where many borrowers — especially Black and Brown borrowers — are saddled with far deeper debts, and the root causes of educational inequity remain largely unaddressed.

“This $10,000 further marginalizes the already most-marginalized,” said Dr. Richelle Brooks, a member of the Debt Collective and founder of ReTHINK It, who currently owes $240,000 in student loan debt. “There are millions of working class people — especially Black women — who won’t see any benefit from this,” she said, emphasizing the announcement’s small impact on those with far larger debts.

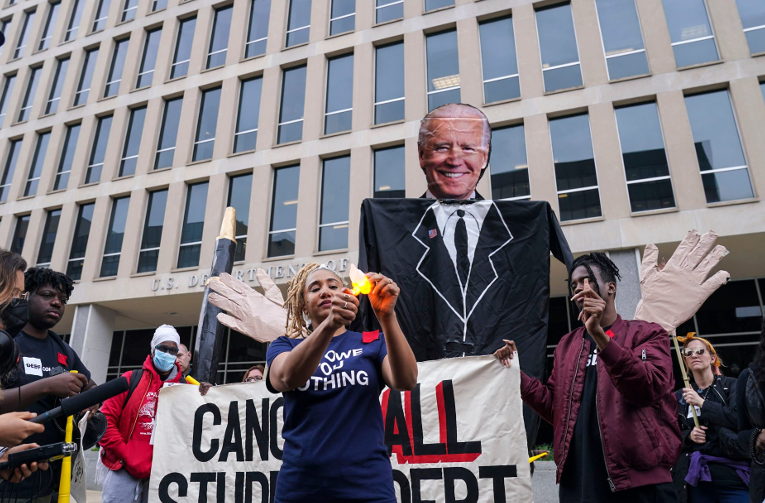

Since 2012, the Debt Collective, formed in the aftermath of the Occupy Wall Street movement, has been organizing student debtors, many of whom have embraced debt strikes as a tool and expression of racial and economic justice. Brooks is a member of the Biden Jubilee 100, a group of 100 student debt strikers who’ve declared themselves on strike from ever repaying their student loan balances, and are demanding that Biden cancel all debt.

Student debt is currently at a record-breaking $1.8 trillion among 45 million federal borrowers, and the average borrower owes $28,950, with a disproportionate impact falling on communities of color. But, for Black borrowers, who hold an average of seven times less wealth than their white counterparts, those numbers are even starker. More than 70 percent of Black students go into debt to pay for college, and Black women graduate with an average of over $37,500 in student debt.

Biden’s plan will forgive debts of up to $10,000 for individuals who earn under $125,000 per year or married couples who earn under $250,000. The recipients of Pell Grants, designed to help low-income students pay for college, will be eligible for an additional $10,000 in relief. Biden also extended the current pause on federal student loan payments until Dec. 31.

The pause on repayments has been in place since the pandemic began — an initiative that some organizers credit with setting the stage for more permanent relief.

“It’s easier to make something permanent if you make it temporary first,” said Melissa Byrne of We, The 45 Million, who has been organizing against student debt since 2010. “Everybody realizes that it’s a choice to put people in debt for getting an education.”

An estimated 20 million people will likely see their debts forgiven entirely by Biden’s plan — a life-changing moment for debtors, and in some ways, a gratifying one for those who have spent years fighting and coping with government inaction.

Yet, for organizers like Brooks, who has worked tirelessly towards debt abolition, the announcement also felt in some ways like “a slap in the face” for those most affected by the debt crisis.

“As a core organizer in the movement — many of us are Black women, and we’re disproportionately impacted by the student loan debt crisis,” Brooks said. “And, we’re going to be helped the least.”

As for what comes next, Brooks and other organizers don’t plan to let up on their demands that the federal government cancel all student debt, make college free or affordable, and address the predatory practices that continue to perpetuate the crisis.

“We need people to strike with us, and not make a single payment come January,” Brooks said. “We need to explain to Joe Biden that we mean business, and we have the power. Especially if you can afford to pay, because I can’t afford to pay — the poorest people can’t afford to pay.”