As with many public conversations in 2020, it is difficult to get past the loudest and most obnoxious voices. I keep reminding myself that I am hearing them precisely because they are the loudest and most obnoxious, to not let that reality distort my searching for deeper truths. I remind myself, but I’m human, and so I struggle. We may have to struggle together here.

I will acknowledge having a lot of difficulty with the discussions around reparations for slavery. The word “reparation” comes from a Latin word meaning “to restore,” which has always seemed to me to be the wrong framing. Nobody is actually talking about restoring things to a past condition—that would be absurd—but more about catching up, about putting the descendants of former slaves on a just footing with other Americans. That’s a different and obviously very difficult conversation, one with a lot of nuance and complexity.

Mural at 31st and Troost in Kansas City. Image source.

For some, cash payments as reparations seem to offer a pain-free solution to dealing with all that nuance and complexity. If we’re going to give trillions to global corporations pretending that, in the next year, Americans are going to start flying for pleasure or booking time on cruise ships, why can’t we give a couple trillion to African Americans to make up for decades of mistreatment? In that mindset, reparations are reduced to a transaction, with an aura almost like that associated with the Catholic practice of purchasing indulgences to lesson one’s time in purgatory.

Almost. Maybe it’s my Catholic upbringing, but the idea of restoring someone, of righting a past wrong and making them whole again, necessarily includes some penance. It includes some sacrifice by the restorer as an acknowledgement of not only the wrong that has been done but, more importantly, of a common humanity shared with the person who has been wronged. We double down on injustice when we focus on the transaction of reparations without thinking through the need for shared cultural penance.

These are philosophical concerns, but I also struggle with the practical. What form should reparations take? How much should they be? Who should pay them? Who should receive them? How should that transfer be made? What will happen if this is done? Would it really help anyone? I don’t have the answers, but the proper approach seems much more nuanced and complex than a simple transaction. And perhaps more local.

Our friends at the data analytics firm Urban3 have done extensive research into the past and present financial state of the Kansas City region. This dramatic work included a series of maps analyzing the impacts of redlining. Not only do these maps provide a detailed picture of the damage that has been done, it also presents an opportunity for Kansas City—and other cities like it—to engage in its own reparations program.

Redlining in Kansas City

Kansas City developer J.C. Nichols. Image source.

Redlining is a practice that emerged during the Great Depression as the federal government attempted to stabilize the mortgage market. A precursor to Fannie Mae and Feddie Mac, the Home Owners’ Loan Corporation (HOLC) was a government-sponsored corporation set up during the New Deal to help people purchase and refinance homes. The HOLC borrowed money by issuing bonds, then used that money to buy qualifying mortgages. They (and the Federal Housing Authority shortly after them) created a market for longer-term loans, loans with lower down payments, and loans to first-time homebuyers, all products that were generally too risky for local banks to hold.

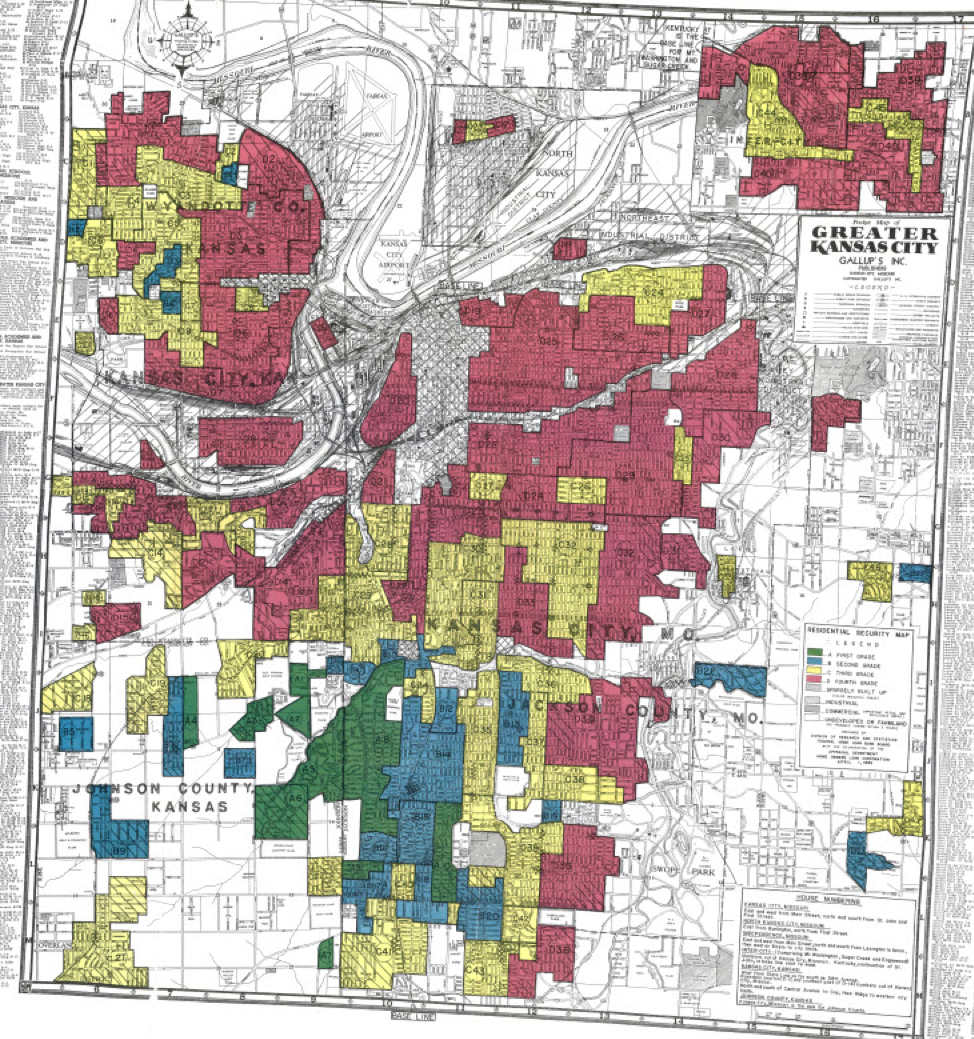

In order to process loans in bulk, HOLC established guidelines for the types of mortgages they would accept. They left it up to local processors to put those guidelines into action, which happened by literally drawing up maps—a Residential Security Map, now often called a “redlining map”—to identify low-risk neighborhoods where HOLC would accept mortgages and risky neighborhoods where they would not.

In 2020, we’re very quick to jump to the worst interpretation of past intent, a practice that conveniently allows us to create moral separation between humans of the past and humans today. Reality is, again, far more complex. The HOLC was a private corporation backed by the public. There were good, rational reasons why, as a government-backed corporation, it should seek to minimize risk. One only needs to ponder the failure of Fannie and Freddie—where executives and shareholders booked the gains from risky loans while taxpayers footed the bill for the bailouts—to see the kind of moral hazard that can develop from government-sanctioned imprudence.

In other words: It was theoretically possible to draw a map, and redline an area, based solely on financial considerations. In fact, that is what the act that created the HOLC called for. One need not have a racist intent to produce a discriminatory outcome, an observation that was as true in the 1930s as it is today. This is an important distinction to note when pondering reparations and what we do today as a society.

Even so, in practice, the racist intent is impossible to deny. It’s everywhere—not only in the dialogue of the era but in the official documentation itself. Here is what Kansas City’s HOLC map looked like. The four grades are:

-

A – Best

-

B – Still Desirable

-

C – Definitely Declining

-

D – Hazardous

A total of 52% of 1930s Kansas City was designated as hazardous. HOLC describes hazardous areas as being “characterized by detrimental influences in a pronounced degree, undesirable population or an infiltration of it.” The instruction to local lenders was to refuse to make loans in these areas, or make them only on a conservative basis. In Kansas City, the “undesirable” population was mostly black, but also included some recent working-class immigrants from places like Italy and Belgium.

Pause and understand the immediate effect of being a homeowner in one of these declining or hazardous areas. Once redlined, there was virtually no market for your home. You could only sell to people who could pay cash because anyone who needed a mortgage couldn’t get one. To say this destroyed property values is an understatement that fails to convey the negative feedback loop of disinvestment and predation that followed. All because of a line on a map.

Meanwhile, down the street in neighborhoods chosen for investment, the feedback loops ran in the opposite direction. Sure, the people there may have worked hard, paid their debts, and lived prudent lives, but their fortunes were buoyed by a federally-backed spigot that generously poured capital into their neighborhood. Rising property values not only helped these families build wealth but helped them overcome misfortune along the way.

This difference in margin of error is perhaps the most pernicious aspect of redlining. The people in one neighborhood are dealt face cards and aces. Those in the other neighborhood get dealt twos and threes. It doesn’t matter how good you are at poker. It’s hard to mess up a winning hand, just like it’s hard to play your way to success when the deck is stacked against you.

The Financial Impact of Redlining

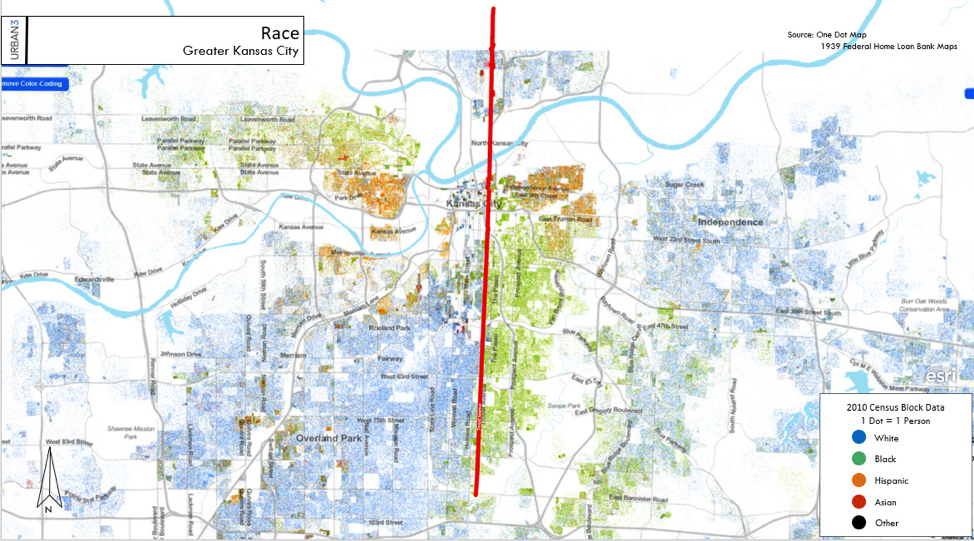

These different trajectories have echoed through time with predictable, yet devastating, consequences. Urban3 put together a map (based on the Cooper Center’s racial dot map of 2010 census data) that shows where people of different races now live in Kansas City. I recognize the data lacks block-level nuance, but the overall pattern is stunning. The thick red line running north and south is Troost Avenue, a street labeled by the famed Kansas City developer J.C. Nichols as the “de facto division” between white neighborhoods and black neighborhoods. Decades later, that same pattern holds.

Source: Urban3

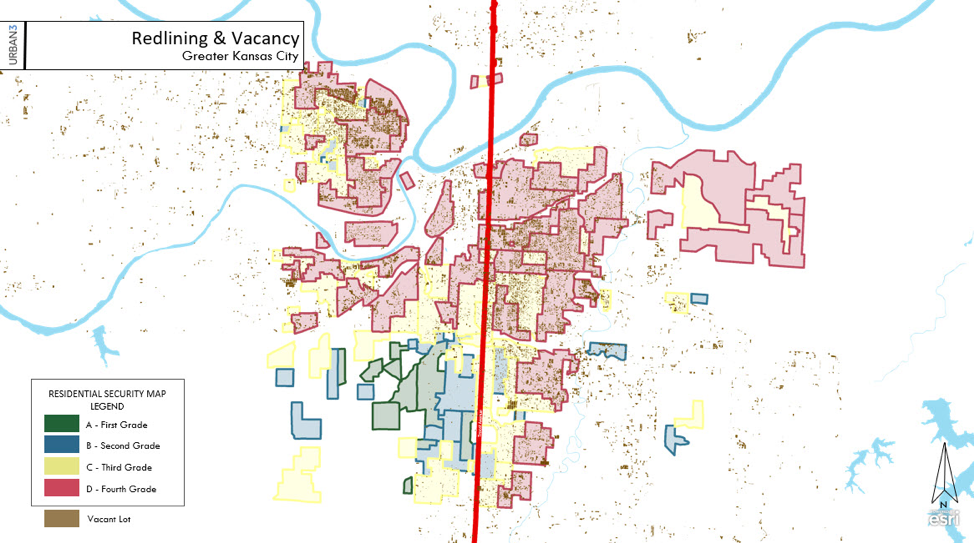

The next image shows the Residential Security Map designations with that same red line running north and south. Just as it was in the 1930’s, today the A and B zones are occupied mostly by people who identify as white while the C and D zones are occupied mostly by black people, with some Hispanic concentrations on the north side. The little brown dots represent lots that are vacant today. They are most predominant in those “hazardous” areas, the redlined neighborhoods that experienced disinvestment.

Source: Urban3

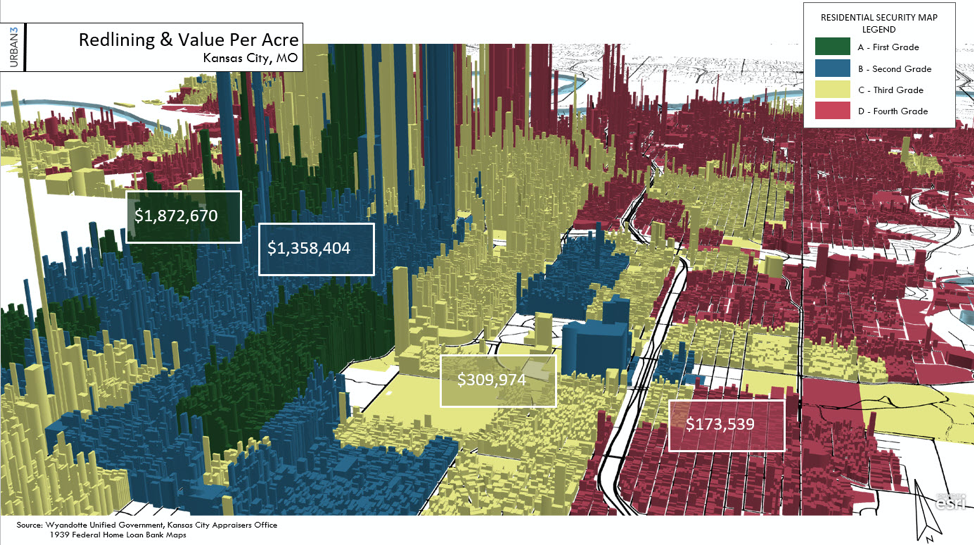

By conspiring to deny capital to some neighborhoods within the city, Kansas City lenders not only inflicted real financial harm on their neighbors, they undermined the well-being of the entire community. A dramatic map demonstrates the extent of the damage.

Source: Urban3

As shown, the financial productivity of the A zone today is nearly $1.9 million per acre. In the redlined D zone, it falls to just under $175,000. That’s 11 times more wealth, 11 times more tax revenue, from the federally-supported zone than the redlined area. And that is just one year; the community has experienced this self-inflicted loss of capacity year over year for more than eight decades.

Across the state line in Kansas City, Kansas, Urban3 estimated the tax loss to the community from just one ½ sq. mile neighborhood. Merely by inducing lots to stay vacant in the redlined zones instead of developing to the modest scale of the rest of the neighborhood, the lost opportunity for expanded tax base has cost the community over $30 million since 1937. That is real tax revenue the community has lost, and that’s just in one small neighborhood! That pattern of disinvestment and loss is repeated over and over throughout the region.

The millions in lost tax revenue doesn’t take into account any of the positive feedback loops that come from having additional investment. It’s time to put those feedback loops to work for the people living in these redlined areas.

What Local Reparations Might Look Like

To put wealth in the hands of the people who live in these redlined neighborhoods, two things must happen. First, the neighborhood must experience investment, an inflow of capital that stays within the neighborhood. Second, that capital must be allowed to accrue to the people who are already there; it can’t result in their displacement.

1. Investing in Disinvested Neighborhoods

For example, in the Bryant Elementary neighborhood on the Kansas side of the river, there are 732 vacant parcels. This neighborhood was redlined into the D zone. Added together, these vacant properties create less than $300,000 in taxable value. (The remaining 867 occupied lots in the D zones create $14.7 million in total taxable value, a productivity of $107,000 per acre, which is extremely low for the region). If the vacant parcels were developed, even at the modest levels of the rest of the neighborhood, it would add over $12 million to the tax base. The first step of local reparations should be to get those 732 vacant lots built on.

On both sides of the river, local governments have demonstrated a propensity for doing some ridiculous tax subsidies, handouts that had no chance to pay off (and, indeed, have been tremendous net losers). The reparations aspect of the neighborhood investments we propose might involve some short-term negative cash flow, but I don’t think it needs to. Either way, a reparations investment today in redlined neighborhoods will pay off financially for the community over the long run.

I’m not sure how one would legally determine who qualifies for assistance (I’ll leave that up to experienced lawyers), but I would give anyone in Kansas City who qualifies the following:

Troost Avenue, the historic racial dividing line in Kansas City. Image source.

-

A free lot. Start with those in tax foreclosure. When that inventory is gone, the city could acquire the remaining lots in the neighborhood (they are really cheap) or partner with one of the many great community foundations in the area to purchase them.

-

Waive sewer and water connection fees and any public assessments currently due on the property.

-

A dollar amount to go towards construction or a down payment on a finished home, an amount that will be recovered in a decade (so, something like $30,000).

-

This amount should vest over a 10-year period of time, so that investment will not only build wealth, but encourage stability.

This all feels like stuff the city would bend over backwards to do for an outside investor coming in looking to build a hotel or a condominium. We know in Kansas City those are generally bad investments with negative returns. In contrast, this is a positive investment, the kind that not only makes good on the promises of the community, but actually pays off financially.

That’s because, if you get the vacant lots developed and get the neighborhood moving in a positive financial direction, all the property values are going to increase. The neighborhood—where there are already underutilized public investments in infrastructure—will get an additional $12 million in property value just in building on those vacant lots, but there will also be appreciation of value beyond that. If the positive feedback loop nudges property values up 5% a year—a very conservative investment given the lower starting point along with all the love now being shown the neighborhood—the neighborhood will go from being worth $14 million in 2020 to $43.5 million in 2030.

That’s nearly $30 million in additional real wealth that has now accrued to the people living in this one redlined area, millions more than what the city has invested by that point. That’s a legitimate down payment on reparations, one that can be repeated across similar neighborhoods throughout the region.

To credibly call this reparations, however, the community is going to need to put their heart into it. That means redirecting city staff and cities’ capital investment programs so that these distressed neighborhoods get at least their share of public investment, perhaps more. Again, I’ll reiterate, in terms of sheer investment for the community, these neighborhoods are distressed assets ready to explode in value. More than any greenfield development the city can make—and, incredibly, those are still happening—investments in redlined neighborhoods will pay off in real financial terms.

This program might be reparations, but it’s not charity—unless you consider decades of HOLC, Fannie Mae, and Freddie Mac support for white homeowners to be charity.

2. Keeping Wealth in the Neighborhood

To keep wealth in the neighborhood, and to keep these redlined areas from becoming playgrounds for financial predators, the city needs to make some systematic changes to its development approach. These changes can be made citywide—which we would recommend—but if that is too difficult, at least make them to protect these distressed areas. The changes that follow are by no means a comprehensive list, but they reflect the best practices of a Strong Towns approach. That includes a capital investment strategy based on the urgent struggles of people living within the neighborhood, an approach centered on humble observation, iterative improvements, and continual feedback.

Zoning Changes

Zoning changes to allow neighborhood-compatible businesses to open. Part of building wealth is being able to start a business, or walk to a place of employment, or get your daily essentials without needing to get in an automobile. The more we allow these neighborhoods to become self-sufficient, the less capital will leak out, and the more wealth will accrue to the people who live there.

Incremental Development

To prevent gentrification, development should be limited to the next increment of intensity. That means a vacant lot gets a home or a business. A single house can add a second unit or become a duplex. To broadly build wealth, we want the neighborhood to experience the positive feedback that comes along with rising land values. Large leaps in the development pattern—say, replacing a cluster of single family homes with a five-story apartment building—will artificially stagnate the neighborhood while land speculators wait for the next big investor. To make reparations, we need to allow redlined neighborhoods to be rebuilt by many hands, not just a few.

To that end, philanthropy can fund support from the Incremental Development Alliance, an organization that trains individuals to be small-scale developers. The training can focus on building capacity within redlined neighborhoods so the people there not only accrue the wealth, but can earn a living during the process while directing the outcome themselves.

Grants

A housing grant program like the one used in Oswego, New York—in which grants for home repairs and facade improvements are made contingent on the participation of a critical mass of neighbors on a single block—is another way to broaden both participation in restoring these neighborhoods and enjoyment of the benefits. This is another opportunity for philanthropy to be involved, using modest sums of money to bring neighbors together and demonstrate visible commitment to the neighborhood.

Tax Increment Financing

And while there are certainly many more ideas that a city committed to making reparations could bring to the table for the benefit of all, a three-decade commitment to recycle the tax increment gained back into the neighborhood—for better parks, schools, sidewalks, and other neighborhood-directed scaffold for prosperity—is only a modest expansion of standard incentives routinely offered developers. It also sends the right message to everyone who calls Kansas City home.

That message: What happened here was wrong—so wrong we can’t make it right, but as a community we can now commit to making this a prosperous place for everyone. That’s what we intend to do.