We who have been suggesting that a peak in world oil production was nigh almost from the beginning of this century looked like we might be right when oil prices reached their all-time high in 2008. But since then, we have taken it on the chin for more than a decade as the U.S. shale oil boom kept adding to world supplies—even as production in the rest of the world mostly stagnated or declined.

But then world oil production turned down—not when the recent coronavirus pandemic and associated economic shutdowns hit—but more than a year before while few people were noticing. Monthly fluctuations will make it difficult to pinpoint a peak until long after it occurs. But, let’s note the difference between world output in November 2018 which was 84.5 million barrels per day (mbpd) versus December 2019 which was 83.2 mbpd when the world economy was supposedly still in high gear. (These numbers are for crude plus lease condensate which is the definition of oil on major oil exchanges.) Between these two dates monthly oil production was occasionally lower than December 2019, but never higher than November 2018.

Does this mean oil production has reached an all-time peak?

Recent developments tend to suggest an affirmative answer. With the dramatic drop in both oil consumption and oil prices since the onset of the pandemic, the oil industry is now flat on its back. Capital spending on new projects has been slashed drastically in the wake of these developments. Revenues are dropping as oil production is being shut in awaiting higher prices and as many firms file for bankruptcy.

To believe that the world will soon return to and exceed its November 2018 oil consumption, one must believe in a quick resolution to the current downturn and the infections that led to it and also that confidence among consumers worldwide is still high. Germany re-opened many of its retail stores about a month ago, but the flood of consumers seeking to satisfy pent-up demand did not appear. It is important to note that this is happening in a country with a substantial social safety net in which the official unemployment rate is 5.8 percent as of April 30.

In the United States, the world’s largest economy, the official unemployment rate stands at 14.7 percent. Is there any reason to believe that Americans will be more eager than Germans to flock to retail stores as lockdowns are lifted in the United States?

Last week the Chinese government dropped the long-time practice of targeting economic growth saying it won’t announce a target for this year. Could it be that the Chinese economy won’t grow at all in 2020? Zero growth is not exactly an exhilarating target for the government to announce.

If consumers worldwide are reluctant to spend, then the world economy will continue to slump. And, spending will likely not reach the pace it did in 2019 until there is solid job growth and a feeling of job security among many more people.

Meanwhile, low oil prices will make it difficult for the world’s oil companies to justify spending on new supplies even as the natural production decline for existing wells takes its toll on production capacity. Whether you believe the decline rate is 8 percent per year as some in the industry claim or closer to 4 percent as one energy consulting firm suggests, the decline rate has a relentless and compounding effect on world production if there is not a correspondingly robust drilling program to counter it. Is it reasonable to believe that there will be?

If overall oil demand remains 20 percent less this year than last, why would oil companies consider drilling for new supplies until capacity dropped nearer to where demand is? The longer those companies wait to replenish supplies in earnest, the more difficult it will be to return to production levels last seen at the end of the 2018.

Those who predict a “V-shaped” recovery will say we will be back to that level within perhaps a couple of years. Those who think the recovery will look more like an “L” must acknowledge that oil companies will simply not add to world supplies until it becomes profitable again to do so. That could be several years from now.

The real wild card is whether consumers will be able to afford the higher prices that are necessary to support increased industry investment. If they can’t, we could get caught in a zig-zag decline in oil production that will imperil all future growth.

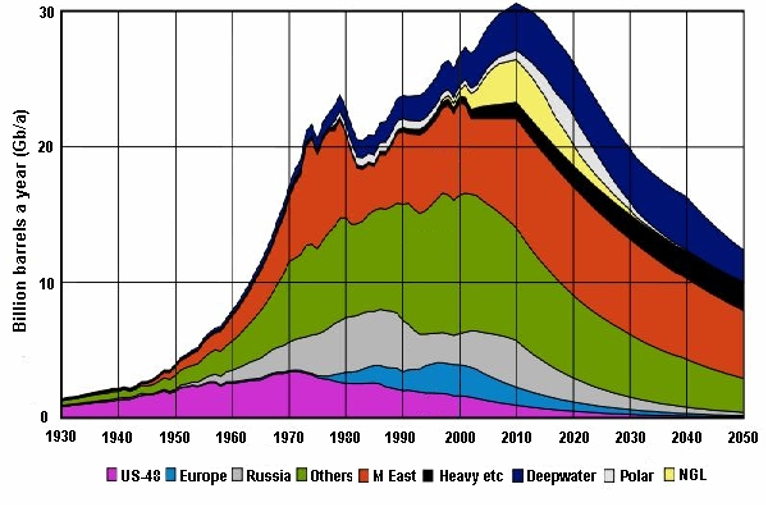

Image: Chart for Global Peak Oil Forecast. From the newsletter of the Association for the Study of Peak Oil and Gas (ASPO) modified by Gralo. 2004.