Matt Mushalik, is a CPEng (Chartered Professional Engineer) and runs the blog Crude Oil Peak.

Peak Oil in South & Central America

Production peaked 2015 due to Venezuela’s production collapse. Brazil’s production has not yet peaked but is unlikely to offset Venezuela’s decline. All other countries together are on a bumpy production plateau for the last 20 years.

January 5, 2021

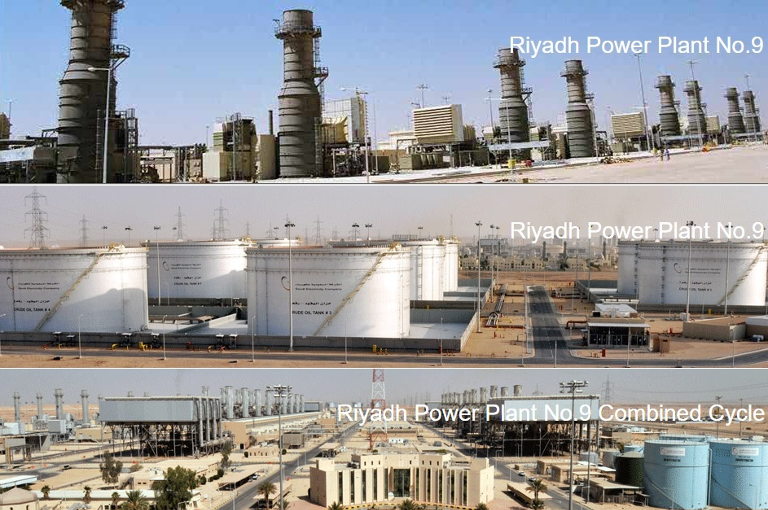

The Attacks on Abqaiq and Peak Oil in Ghawar

The world cannot live without Saudi oil. While media focus is on oil prices and how quickly full production can be brought back Saudi Arabia’s underlying peak oil problem has not been discovered yet. Together with the permanent threat of further attacks there is a double vulnerability now.

October 16, 2019

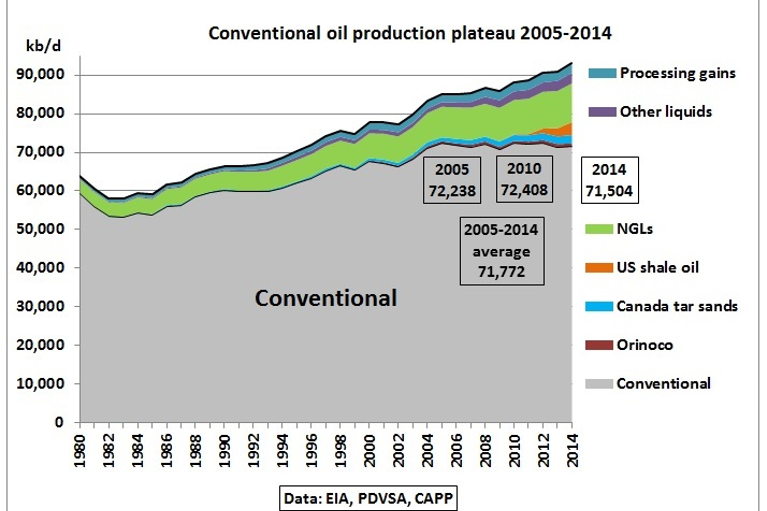

2005-2018 Conventional Crude Production on a Bumpy Plateau – With a Little Help from Iraq

In the last 4 years, conventional crude production was just 1 mb/d higher than in 2005. This was mainly an increase from Iraq (which was 2.7 mb/d).

September 11, 2019

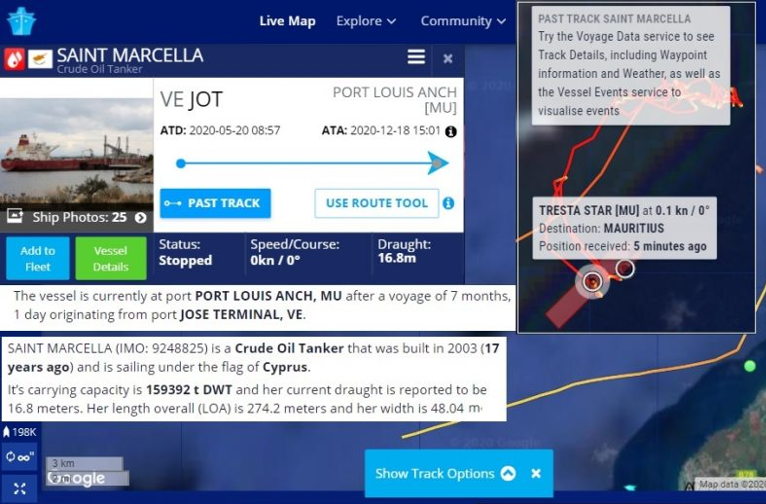

Persian Gulf Oil Export Peak after Tanker Attacks?

Oil exports from the Persian Gulf have been peaking in the last 3 years 2016-2018 at around 22.3 mb/d. That was before the US sanctions on Iran were tightened in the 1st half of 2019.

July 2, 2019

Saudi Update October 2018

Saudi Arabia’s net liquids exports are not growing commensurate with oil demand in Asia, the destination of 70% of Saudi oil. If something were to happen in this country impacting on oil production and/or oil exports, this would worsen the situation and hit Asia’s and therefore the world’s economy.

November 2, 2018

Almost Half of Australia’s Petrol, Diesel and Jet Fuel Imports come from South Korea and Japan

As the world wonders what comes next in the North Korean missile crisis we need to have a look what a military confrontation would mean for Australia. This is important because after 3 refinery closures in Clyde (Sydney), Kurnell (Sydney) and Bulwer (Brisbane), fuel imports from East Asia have replaced previous crude imports coming from a variety of countries outside the Korean conflict zone.

August 21, 2017

1 thought on “Matt Mushalik”