Understanding the crisis in Ukraine from a peak resource perspective

No, this war is not (just) about getting Ukraine’s resources. Other political ambitions aside, this one is more about the rest of Europe losing its energy suppliers, together with its political power — and stability.

It is no wonder that we use the same word — power — to describe both the use of political force and the rate of energy transfer. It’s almost an axiom, that the more energy (and other mineral resources) a nation has, the more political power it possesses over its neighbors. It is also important to note, that power is relative: you don’t need to have all the energy of the galaxy at your fingertips — it’s enough to have a little more than the next country in the row.

In an abundant and growing world (i.e. between 1950 and 1970) this was of little concern. Each and every country had enough —i.e.: enough to generate as much energy and provide as many minerals and as much food as they needed, with room to grow — so no one was really bothered to steal from their neighbors. Of course this was rarely the case and thus the post WWII years can now be safely considered the biggest anomaly in human history. In ages of discontinuity however, like the one we live through now, the role of energy is hard to overstate.

Yet, our political leaders and economic pundits would still like to believe that we are in the 80’s and 90’s, the roaring decades of globalization with an ever increasing number of cargo ships criss-crossing the planet’s oceans… Where every international issue and local shortage could be resolved by trade deals or embargoes. What we are witnessing at the moment however, is a dissolution of this idea — together with the myth of infinite replaceability and the effectiveness of sanctions.

Letting the idea of infinite growth join the prestigious group of ideas on the compost heap of history would be the next logical step, but let’s not get ahead of ourselves just yet.

The problem with discontinuities is that they tend to come at the worst possible time. The world economy was just about to “rebound” from a slump caused by one of the worst pandemics in recent memory… and then came first a lumber shortage, then a row of supply chain disruptions, then an energy crunch combined with a shortage (and a resulting price increase) in almost every commodity.

Viewed from a peak resources perspective this all makes instant sense. Our politicians however would like to think, that this is just a bump on the road and everything will be back to normal by 2024. Ok, maybe 2025. There is a subtle change in language however. I used to remember back in the good old days (90’s and 2000’s), every chart depicting resource use was displayed like a graph trending upwards and upwards, possibly into the stars. Now they tend to depict everything (from current extraction trends to inventory levels) in comparison to the last five years’ average. Honestly, this drives me nuts. These charts convey the message that we have reached some sort of “mature” level of production, where every year fluctuates around an average — with some better and worse years. They paint a picture of a world in a perfect balance described by stable flows of energy and raw materials. In fact, as we will see, the world is anything but…

What these charts fail to show the world is that we have slowly reached a bumpy plateau of production, from where the start of descent is just matter of time. They speak a language of flow rates (x ton/year, y cubic feet/year etc.), without any reference to the stock (reserves) or the depletion rate. (I.e.: how much we have left, and how the perfectly natural process of depletion will result in a slow descent of the given resource’s availability over time).

The world economy is driving towards a cliff, in a willful ignorance to the warning signs beside the road.

Given this context it is absolutely no wonder why 8 years had to pass between the annexation of Crimea and a full scale war in Ukraine. By now it has become clear that Europe is definitely on the long slope of decline (energy wise) and that its political prowess is not what it used to be. The West can no longer credibly pretend that it can easily withstand the turning off of gas taps. Natural gas production has been falling over decades now, LNG imports have become limited by capacities at terminals, and there is an ever increasing need for load balancing “renewables” — not to mention the increased demand for electricity baseload from gas plants replacing nuclear and coal (temporarily). In other words, as I’ve referenced Nafeez Ahmed earlier last year: Europe is in trouble. Its energy sector, and thus its real economy, has become terribly dependent on Russia.

And it is not just energy, but metals and fertilizer production as well. In this ‘molecule crisis’ where basically every commodity is in under-supply, losing 6% of the world’s aluminum or 15% of fertilizer output is not an option. (For the record: these are the most energy intensive materials and thus at the cross-hairs at every energy saving measure.) Viewed from this perspective the war has been started exactly at the right time for Russia: when gas storage in Europe is at its lowest and metal/fertilizer prices at their highest — in some cases the highest ever. Thus the chance of avoiding long term sanctions is the best. Even if sanctions would hit, Russia has piled up ample reserves of hard currency and gold — amounting to 42% of its annual GDP to keep its economy going despite a plunge of the ruble.

What about resources in Ukraine? Well, they posses one quarter of Europe’s coal reserves… 90% of which is high quality anthracite located in the Donets Basin (or Donbas), occupied by sesaratist groups of Luhansk and Donetsk. True, Russia has plenty of coal too, but, most of it is located in Southern Siberia, some 4000 km inland to the east. Since coal is a heavy and bulky material, it is expensive to transport on land (especially in energy terms), but can be easily carried by barge on the rivers of Eastern Europe. Donets also happens to be near the coast of the Black Sea, and thus near European markets reachable by bulk carriers. Ever wondered why the separatists wanted to capture the port of Mariupol in 2014/15?

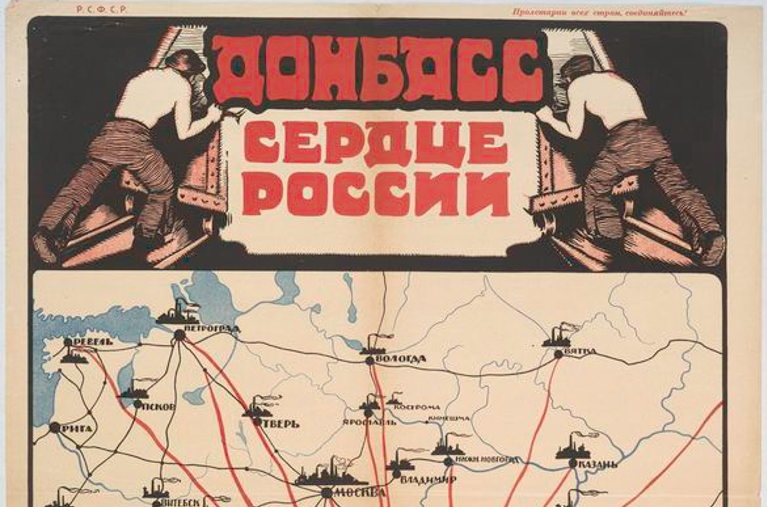

Propaganda from 1921 — a reminder from history. The sign reads: Donets Basin is the heart of Russia. Image source: Wikipedia

‘Coal? Bah! We have wind turbines!’ Sure, but as the case with rising gas prices has shown the world, “renewables” will not be able to save the day. Much to the detriment to our climate, coal is still a “popular”, although heavily polluting option to provide the grid with baseload electricity — something dismantled nuclear power plants, wind turbines on a windless week, or solar panels at night cannot do. Also, coal is indispensable in steel making, necessary to erect those white towers with spinning blades on top — a raw material whose price is now soaring too. Despite Net Zero targets, with peak oil (1) most probably behind us and a looming peak in gas extraction, Europe will be forced to use more coal.

If Russia “succeeds” in erecting a puppet government in Ukraine, its mining companies would be provided free access to the coal basin— enriching oligarchs beyond measure… At the cost of many lives lost and a nation deprived from its freedom.

Until next time,

B

Notes:

(1) Iran may return to the oil market following a potentially successful nuclear deal with the West. At the same time however Mexico will exit the market next year, and depletion will keep on doing its business unabated in the rest of the world… Leaving us with a potential, although short lived, secondary peak early next year.