Trading was relatively quiet on Monday and Tuesday; however, the oil markets took a giant leap upwards on Wednesday closing 5.7 percent higher at $47.15 in New York and and 4.2 percent higher in London at $49.75. It seems that a lot of traders believe the oil glut thesis has been oversold and that a big price rebound is coming any day now. These traders are ready and willing to bet heavily on higher prices on almost any sign of better times ahead. On Wednesday a sign came when the EIA announced that US crude stocks had declined last week by 2.1 million barrels and even more importantly stocks at the Cushing, Okla. hub were down by 1.9 million barrels. The Cushing number had already been predicted by a market intelligence firm Genscape on Monday after a private survey and the overall decline in crude stocks by the American Petroleum Institute’s survey released Tuesday evening. The financial press, however, likes to make much of their own analyst surveys which are frequently off by millions of barrels, sometimes in the wrong direction, and makes much of the “unexpected” when the official results are released.

This time the markets completely ignored the main message in the weekly stocks report which was that US refiners are continuing to convert crude into oil products at an an unusually fast pace for this time of the year so that gasoline stocks were up by an “unexpected” 2.8 million barrels; distillate stocks were up by an “unexpected” 3.1 million barrels; propane stocks were up by 1.1 million; and the US had to find a place to store an additional 8.5 million barrels of commercial petroleum inventories. US refiners increased their crude processing by 403,000 b/d last week turning more crude in oil products than were needed for consumption.

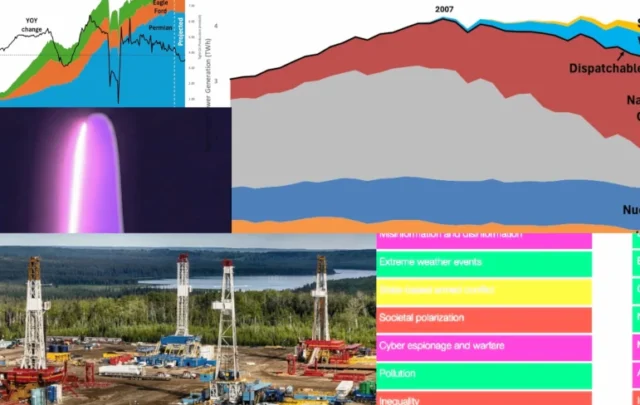

While it is clear that US shale oil production is declinong, the pace of the decline is rather murky. The EIA told us on Monday that production from the major shale-oil fields is likely to fall by 80,000 b/d between September, and October, but when the state data, which is six weeks behind but has been more accurate, comes in production does not look so bad. On Monday North Dakota reported that its shale oil production was down by only 5,400 b/d in July. The EIA says that last week US oil production was down by 17,000 b/d or 0.2 percent. In a world that produces some 93 million b/d, this should not have much of an impact. It seems clear that we have a way to go before the shale oil production picture is completely clear.

There has been much discussion in the press recently concerning the “financial reckoning” that is about to fall on the oil patch. For the last year US energy companies have borrowed billions of dollars to stay in operation with oil selling well below costs of production. Many expect that credit lines will be cut substantially in the near future and that many companies will have to merge or declare bankruptcy.

The US Congress continues to muck around in the oil business. The House of Representatives plans to vote on a bill to lift the oil sanctions, despite the lack of support from the White House. There have been many impassioned speeches claiming that exporting US oil will lead to a major economic upsurge. Although most believe Congressional efforts to torpedo the Iran nuclear treaty are behind us, the Republicans in the Senate are still at it. On Tuesday the Senate Democrats blocked legislation meant to kill the agreement for a second time.

Overseas, the new from China concerning its economy and stock market is still bad. Moscow seems determined to save Assad by sending more arms to Syria and Baghdad has warned the foreign oil companies working in Iraq that there will be little or no money to increase production next year.