Recently, the Sustainable Economies Law Center (SELC) gathered community members for a conversation on “Mutual Aid, Lending Circles, Giving Circles, and Gift Circles.” The conversation focused on creative alternatives to mainstream financial services such as banks and insurance. Each alternative was premised on mutual aid and the notion that borrowing money and preparing for financial emergencies should happen in the context of equitable relationships, as opposed to relationships aimed at generating profit margins for big banks.

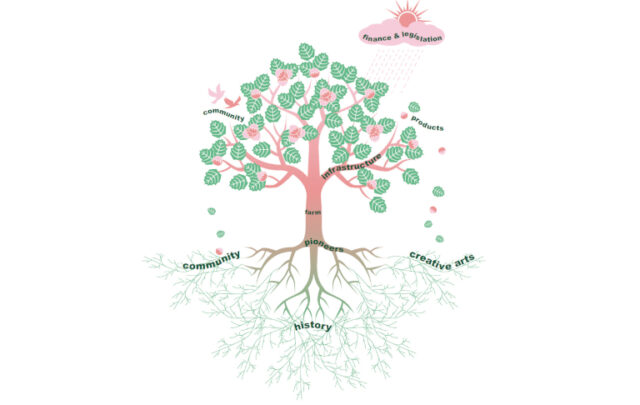

This article outlines the group’s discussion, including historical background of mutual aid practices, the significance of mutual aid today, examples of mutual aid in the community, and the operational and legal questions that must be considered as these practices become widespread. Below we cover the various mutual aid practices discussed.

Mutual Aid Societies

A mutual aid society is an organization formed to provide mutual aid, benefit, and/or insurance among its members. Benefits are not necessarily monetary and may include services and social activities. Members of mutual aid societies have a democratic voice in the organization and have an equal opportunity to receive benefits, depending on their needs and the needs of others.

Some of the first mutual aid societies in the U.S. were formed out of necessity by groups with limited access to mainstream services and support. In 1787, the Free African Society was formed to provide aid to newly freed blacks, so that they could develop leaders in the largely exclusionary community. In the late 19th and early 20th centuries, immigrants from various ethnic and national origins formed mutual aid societies to serve as social support groups, extending financial support to each member during illness and unemployment, as well as emotional support during times of loss. Italian-American mutual aid societies were referred to as Societa di Mutuo Soccorso and Mexican-American societies were called Sociedades Mutualistas.

Today, many services provided by mutual aid societies have been assimilated into private and public institutions such as insurance companies and social welfare services. Although they are not as prevalent as in they were in the past, mutual aid societies still exist today and are formally recognized by the Internal Revenue Service as a category of organizations known as Fraternal Beneficiary Societies.

Shepard Fairey’s depiction of mutual aid. Photo credit: eshutt / Foter / CC BY-SA.

Lending Circles

A lending circle generally refers to a group of people who pool money on a regular basis, and either provide rotating loans to circle members or democratically select a member to receive a zero-fee, zero-interest loan. Most lending circles can be categorized under one of the following models: 1) lending, 2) emergency, and 3) hybrid.

A lending circle focused purely on lending requires members to pool money on a regular basis, select the value of the loan, and rotate the loan on an agreed-upon schedule until each member benefits. For example, five individuals meet once a month for a total span of five months. Every month, each member contributes $300 to create a total fund of $1,500. The group democratically decides on whose turn it is to collect the $1,500 as a loan, so that each member receives the loan once. After receiving the loan, each member is still expected to contribute $300 every month to both pay off the loan received and fund the same loan to other members. At the end of the five-month period, each member will both have received and contributed $1,500 to the circle.

For communities that have difficulty building savings, a lending circle of this model can provide immediate access to funds in times of need. Lending circles also ensure that our dollars are used to instantly benefit members of our community, rather than going to a large bank that likely invests the funds in Wall Street. Lending circles offer a way for small groups to be their own banks, in essence.

In contrast to a lending circle that strictly rotates loans, a lending circle focused on providing emergency funds to its members operates more like an insurance provider. Members still pool money on a regular basis and select the value of the loan. However, instead of rotating the loan among members, the money collected is saved and issued to a member only after circle members democratically choose to do so. When deciding who should benefit from the loan, members typically consider who is most in need of financial assistance — often a member affected by illness or unemployment.

Some lending circles incorporate both models above. In this case, a lending circle issues loans to its members on a fixed schedule, but has the discretion to bypass or alter the schedule if members democratically choose to issue the loan to a specific member in need.

All of these lending circle models are an age-old practice used by various societies around the world. They are referred to as tandas or cestas in Latin America, susus in Africa, lun-hui in China, and paluwagan in the Philippines. Immigrant communities have often turned to informal lending circles as a social activity and alternative to unfamiliar and inaccessible financial institutions. As described below, today some groups have made efforts to formalize lending circles, in order to protect members.

Giving Circles

A giving circle refers to a group of individuals who gather regularly, pool their money, and democratically choose to gift their pooled funds to an organization, enterprise, or individual outside of the circle.

Giving circles have emerged in the last decade as a popular method of philanthropy. In 2011, there existed up to 800 documented giving circles in America and a 2009 study estimated that giving circles collectively grant about $100 million a year.

Gift Circles

A gift circle refers to a group of individuals who come together to share their needs and services/goods. Goods and services provided do not involve money and members share with no expectation of anything in return. Generally, each participant is asked to list some of their needs and what they can offer. Participants then have an opportunity to interact and offer support to one another.

Significance of Mutual Aid Today

There are many similarities between social conditions today and those that existed during mutual aid’s heyday. Today, the immigrant population makes up 13 percent of the U.S. population, which is not far from its peak of 14.9 percent in 1890. Five years after the peak of the recent Great Recession, many Americans are still struggling to make ends meet. Cuts to public spending have slowed the U.S. economy’s growth and have disproportionately affected middle to low-income families. Long-term unemployment remains on the rise especially in communities of color, while wages for average Americans have dipped to a forty-year low.

Mutual aid practices can assist low- and middle-income communities alike. Mutual aid societies can lend support during unemployment and offer health and life insurance to its members. Lending circles offer fair and accessible means of borrowing money, and both giving circles and gift circles allow individuals to collectively address their community’s under-resourced needs.

Underserved Communities

Many low-income communities in the U.S. are home to predatory lending services such as pawnshops, check cashing facilities, and payday loan providers. Payday loans, in particular, charge crippling fees and interest rates as high as 400 percent. Many individuals are drawn to these services because of the difficulty of obtaining credit from banks, which has worsened due to the financial crisis and staggering unemployment. Undocumented immigrants often face a steeper uphill battle in accessing credit, as most banks require their customers to provide Social Security numbers or specific forms of identification.

Middle-Income Families

Long-term unemployment and falling wages have devastated middle-income families facing the rising cost of health insurance, higher education, and housing. Following the housing crisis, many middle-income families have found it increasingly difficult to access credit. Others saw their pensions disappear when the stock market crashed, and companies are even encouraging their employees to not rely on pensions to fund their retirements.

Middle- and low-income communities benefit greatly from mutual aid. Photo credit: In Focuz / Foter / CC BY-NC-ND.

Mutual Aid in Action

Community members and organizations have used mutual aid practices to address various issues affecting low- and middle-income communities. The following organizations are examples of mutual aid in action.

Mission Asset Fund

Mission Asset Fund (MAF) is a non-profit organization that facilitates and formalizes lending circles in immigrant and low-income communities. MAF observed the prevalence of check cashing facilities and payday loan providers in San Francisco’s Mission neighborhood and sought to serve as an alternative.

MAF has created a system to ensure that payments and loans are made to lending circles on time and that members can build their credit by reporting timely payments to two of the major credit bureau agencies. Loans are zero-fee, zero-interest and relatively small — a typical loan is $1,000 on a 10-month period. At the beginning of the loan period, lending circle members determine the loan schedule by pulling numbers out of a hat. Each member signs a promissory note and sets up automatic withdrawals from their bank account to MAF’s account so MAF can then distribute the loans according to schedule. Loans are used for things ranging from educational expenses to security deposits. MAF also facilitates lending circles for legal fees associated with Deferred Action and citizenship applications.

MAF has made a substantial impact in immigrant and low-income communities despite only being around five years. Its lending circles boast a 99 percent repayment rate and a 1 percent default rate. Lending circle members have experienced a 168-point average increase in their credit score and an average of $1,051 reduction in debt. By participating in lending circles with the help of MAF, low-income individuals are building credit, escaping expensive debt, starting businesses, buying homes, and saving for college.

Bay Area Mutual Aid

Bay Area Mutual Aid (BAMA) is a mutual aid society comprised of social workers living in the Bay Area who share a common vision of social work and community organizing. Members meet monthly to provide each other mutual aid including education and emotional support. For example, members are encouraged to contribute to the group’s skill share, where they are given the opportunity to share helpful skills, knowledge, and ideas with one another.

Devata Giving Circle

The Devata Giving Circle (DGC) is a non-profit organization comprised of Cambodian-American women who joined together to raise funds for organizations working to advance the leadership and human rights of Cambodian women and girls. DGC is run by an executive council of 8-11 Cambodian-American women who meet monthly, engage in fundraising, and determine who will receive one of the circle’s annual grants.

Each member of the executive council can identify potential grantees and invite them to submit a proposal. Once proposals are submitted, members democratically select grantees through anonymous vote.

Operational Considerations

When forming a mutual aid society, lending circle, or giving circle, members must consider how their circle is managed. Members must address questions such as how to build trust and accountability within the group, what to do if trust is broken, and how to determine membership composition. Some of these considerations are described in more detail below.

Building Trust & Accountability

The foundation of all mutual aid practices is trust and a sense of community. Without trust and community ties, members will not be encouraged to contribute their money, services, and/or time to the group. Members may leave a mutual aid society if they do not believe that the group has their best interests in mind. Potential lending circle members may shy away from participating altogether if they fear someone may run away with a loan and not pay the circle back. Likewise, someone may refrain from joining a giving circle if she does not trust in the circle’s ability to abide by its core values when selecting grantees.

Mutual aid groups may build trust by focusing on the group’s common bonds and engaging in social activities. For instance, mutual aid societies that have tax-exempt status as Fraternal Beneficiary Societies (under section 501(c)(8) of the Internal Revenue Code) are required to have members who are bonded by a common tie or purpose and who engage in substantial fraternal activities together. Lending circles, especially in immigrant communities, traditionally employ this same concept by gathering together not only for financial support, but also to maintain and grow a stronger sense of community. By building strong relationships among members, groups help to ensure that members will feel accountable to the group and remain involved.

Recourse

Even if a mutual aid group does all it can to forge strong relationships among members, a member may still breach her obligation(s) to the group. In this case, there is sometimes not much a group can do if its activities are not formalized through legal contracts. If legal contracts do exist, members in breach can be more easily held liable and sued in court. Additionally, lending circles facilitated by Mission Asset Fund are equipped with the added recourse of negative credit reporting to members who fail to make payments. Of course, these forms of legal recourse are not preferable and the best thing a mutual aid group can do to avoid conflict is to prioritize trust and community connection when selecting potential members.

Demographics

Member demographics and income levels play an important role in the effectiveness and longevity of any mutual aid group. Many sociedades mutualistas went bankrupt during the Great Depression, because unemployed members eventually outnumbered those who were employed, resulting in the depletion of funds. Although mutual aid societies exist to assist during times of unemployment, if member income-levels are too disparate, it can lead to a few members subsidizing others without reciprocity.

Lending circles comprised of members of similar income-levels could potentially be more stable, in part because the monthly amount contributed to the lending circle is directly correlated to how much each member is able and willing to afford. It would be unfair to require a low-income individual to contribute $500 a month to a lending circle comprised of higher-income members if that amount would be too financially burdensome.

In addition to income-level, mutual aid groups can benefit from having members who are bonded by a common tie or purpose. This supports the goal of building trust and forging strong relationships; when members feel tied to one another by a common interest, they are more likely to stay in the group and ensure its effectiveness.

Everyone needs a helpful hand at some point. Photo credit: A National Acrobat / Foter / CC BY.

Legal Considerations

Most mutual aid groups, especially lending circles, operate informally. As such, members who violate the group’s trust are typically not held liable. This is a huge deterrence for people to participate in mutual aid groups, and it has been addressed through entity formation and contractual agreements.

Entity Formation

Mutual aid groups have the ability to form a legal entity just like any other organization. If a group plans to store money in a bank account, forming an entity and allowing it to control the account is beneficial, as most banks generally frown upon putting more than two people on one account. The most appropriate legal entities a mutual aid group can form is a nonprofit mutual benefit corporation or a cooperative corporation.

Mutual aid societies formed as nonprofit mutual benefit corporations could potentially seek tax-exemption as a 501(c)(8) Fraternal Beneficiary. However, seeking tax-exemption as a 501(c)(8) might be difficult for some mutual aid societies due to the “lodge” requirement. In order to fulfill the lodge requirement, a mutual aid society must carry on activities under a form of organization made up of local branches that are largely self-governing and chartered by a parent organization. In other words, a single small-scale mutual aid society cannot obtain 501(c)(8) status until it expands its operations or affiliates with an existing group of organization operating under a unified system.

Giving circles may benefit from forming an entity in order to seek tax-exemption status as a 501(c)(3). With 501(c)(3) status, donations made to the giving circle are tax-deductible, thus giving people more incentive to contribute.

Legal Barriers

Formalization of mutual aid societies and lending circles comes with some disadvantages. If an entity is formed to receive funds and distribute them to members, it’s possible that the entity could become subject to securities laws, banking regulations, insurance regulations and/or money transmitter laws. These laws were intended to protect consumers and prevent financial crimes, but compliance with these laws could be prohibitive for individuals and small groups. Below is a brief summary of the legal issues that may come up.

Securities Laws: There is no simple way to define a “security” as the definition varies across states, but generally, if an individual invests money into an organization and is led to expect a return resulting from the efforts of others, then a security exists. If a mutual aid society or lending circle opts to form an entity, it may be subject to securities laws because members contribute money and are led to expect that they will be given something in return. Giving circles are likely immune from securities laws, as money raised and distributed to grantees are donations with no expectation of a return. An entity subject to securities laws is required to register the securities it offers with the U.S. Securities and Exchange Committee and with securities regulators in the state.

Money Transmitter Laws: Money transmitter laws, arising from the Bank Secrecy Act and similar state laws, govern entities that receive and transfermoney. These laws are primarily aimed at preventing money laundering. Depending on how it operates, an entity that operates a mutual aid society or facilitates a lending circle may need to register as a money transmitter.

Banking Regulations: Mutual aid groups that accept and loan money may also be subject to banking regulations, as a bank, depending on applicable definitions, could be defined as simply an entity that conducts a substantial part of its business receiving deposits and issuing loans.

Insurance Regulations: An insurance provider generally refers to an individual seeking to indemnify another. In California, a mutual aid society operating under a lodge system is legally permitted to provide its members with certain insurance benefits. Although these mutual aid societies are exempt from most sections of the California Insurance Code, they are still subject to certain provisions such as Section 790, which prohibits insurance providers from engaging in unfair or deceptive acts or practices.

Structuring a Simple Lending Circle

To avoid entity formation and the prohibitive regulations that may result, but to still give a lending circle the benefit of legal formalities, members may enter into legally binding contracts with one another. For example, consider a lending circle comprised of five members that meets and issues loans over a five-month period. Every month, each member contributes $500 to the circle, resulting in four $500 loans to the individual chosen to receive the funds, totaling $2,000. If member A receives the first sum, then members B, C, D, and E each receive a promissory note from A, which is A’s promise to pay them by giving to the circle in the future. This process would continue every month over the five-month period until all promissory notes are paid off. The lending circle can avoid the need to open a bank account by immediately issuing the loan to the receiving member. In this case, it is possible to argue that many of the burdensome regulations described above would not apply. There is no need to form an entity, no bank, and no organization acting as a money transmitter or insurance provider. Depending on how the loans are intended to be used, securities laws may or may not apply to the loans. This arrangement is fairly simple and straight-forward; there are just five people making agreements with each other.

The Future of Mutual Aid

Today’s economic crisis has imposed financial hardship on low- and middle-income communities. Despite this, the creativity and resourcefulness of mutual aid groups that prioritize community over wealth maximization have provided pathways to economic stability. With further research and advocacy, these pathways can become more widespread and build the economic resilience of our communities.

Acknowledgement: This article was written with input from Janelle Orsi, Executive Director, Sustainable Economies Law Center.

This article is cross posted with permission from Shareable.net.