A few years ago Citigroup (yes, it’s a bank) came up with the notion of ‘plutonomy‘ to describe the way the economy was coming. It was a neologism, of course, but one that needed little or no explanation.

A few years ago Citigroup (yes, it’s a bank) came up with the notion of ‘plutonomy‘ to describe the way the economy was coming. It was a neologism, of course, but one that needed little or no explanation.

But even three years after the financial crash, we’re still seeing that ethos and that economy on our streets and in our public realm.

Citigroup explained its ‘plutonomy’ concept this way:

Our thesis is that the rich are the dominant drivers of demand in many economies around the world (the US, UK, Canada and Australia). These economies have seen the rich take an increasing share of income and wealth over the last 20 years, to the extent that the rich now dominate income, wealth and spending in these countries. Asset booms, a rising profit share and favourable treatment by market-friendly governments have allowed the rich to prosper and become a greater share of the economy in the plutonomy countries.

Another way of describing it is as the rule of the top 0.1%, by the top 0.1%, for the top 0.1%.

Then the financial crisis came, and banks were saved from bankruptcy by money provided from taxes paid by the other 99.9%, and Citigroup had an attack of conscience, or perhaps public relations, and the newsletters in which they talked about plutonomy were removed from the website. We know about them only because a public interest group salvaged them and returned them to the internet.

But we are living in that plutonomy world, and I was reminded of this last month when trying to find a shop I used to visit sometimes in Bloomsbury. Playin’ Games was once one of the best games shops in London, over two cramped floors, stuffed floor to ceiling with a huge range of games. Something for all pockets, too; a child would be able to find something at pocket money prices. It usually seemed busy, as well.

Selling status

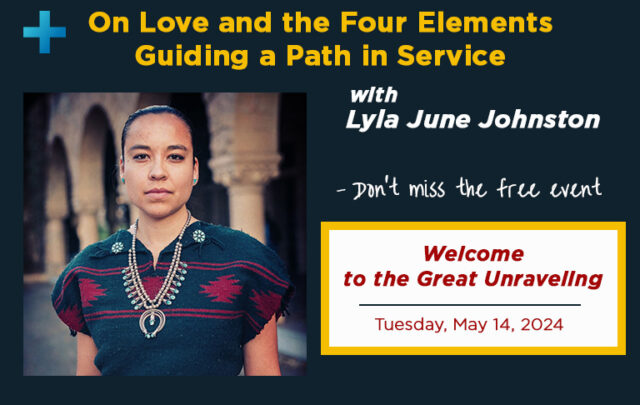

But no more; as I looked for it last month, I found that it had vanished, to be replaced by Mokspace (see the picture at the top). It’s not clear to the passer-by what Mokspace is actually selling – although the website reveals it to be a gallery with East Asian connections. But at the same time, we know exactly what it’s selling; it’s selling status, it’s selling those objects which the plutonomic classes surround themselves with to demonstrate their membership of the plutonomic classes to other members – and non-members.

So it’s perhaps worth unravelling this a little, lest this post is misunderstood as cheap point scoring.

So it’s perhaps worth unravelling this a little, lest this post is misunderstood as cheap point scoring.

Mokspace may well turn over as much revenue from the occasional sale of expensive artworks as Playin’ Games did; its margins may well be higher. In terms of the overall economy, there is probably little change.

Negative social outcomes

But unlike Playin’ Games, which was selling positive social outcomes (playing games is a deep and long-standing human habit), Mokspace is selling negative social outcomes. As we know from the work of Michael Marmot and others, chasing status is a fairly destructive social activity.

Of course, one of the reasons why a shop such as Mokspace chooses to locate itself in this part of London is because of its proximity to the British Museum (similar galleries have gathered around the edges of the Tate Modern). There’s a sharp irony here, since the British Museum was established on a strong principle of social inclusiveness, with free access to its collections, a principle which continues today. Indeed, historically, the Museum was a vast source of self-education in the late 18th and 19th centuries. Hans Sloane, the Museum’s benefactor, would have been dismayed by this sort of elitist cultural retail.

When planning laws have nothing to say

Now, ministers are currently telling us that our current planning laws cost the economy millions, albeit on the basis of discreditable data. But in the case of Mokspace and Playin’ Games, our planning laws are all but silent. It is probably a shop for a shop, so no change of use is involved. Similarly, if a £6 a plate cafe is replaced by a £60 a head restaurant, planning laws have nothing to say. It is not possible to challenge a change of ownership (and the planning use categories are very broad) on the grounds of social impact. We can see the result in every high street; a vanishingly small range of shops, owned by an increasingly narrow range of owners, which works fine only if you want to buy skinny decaf latte, or a new cover for a mobile phone, or place a bet.

This is, I suppose, a version of the Tragedy of the Commons, in which the narrow short-term interests of one class of local actors, in this case landlords, reduce the social wellbeing for the community as a whole. (we know about the reduction in wellbeing from the excellent work done by nef on ‘clone towns‘).

One-sided contracts

Put like that, of course, it is exactly the sort of problem which law, regulation, and institutional governance are designed to manage. But in practice, planning rules are completely toothless in the face of this sort of social erosion by landlords.I don’t know why Playin’ Games closed (though it was probably a casualty of the recession, previously squeezed thinner by online competition, reckons Graham Linehan), and their landlords may have had little to do with it. But one of the ways in which shops get squeezed out of their premises is through the application of upward-only rent reviews at the end of each rental period, regardless of market or economic conditions. I’ve always wondered why these are permitted: they are clearly a distortion of the market and they seem to have poor social and public outcomes. They transfer unearned income to landlords at the expense of more productive parts of society. I can’t think of any other sector where such a one-sided contract would be permitted, and have never heard a credible rationale for the practice. They have just been banned in Ireland, it seems. About time for the Competition Competition to take a look.

The pictures in this post were taken by Andrew Curry. They are published here under a Creative Commons licence: some rights reserved.