Dear theoildrum.com readers. Many of you may have wondered about my absence here over the last 6 months or so. Suffice it to say that I’ve had a sea change of understanding about both our situation and on the opportunities it presents. As such, I’ve made some career change decisions, which Kyle and Gail are allowing me to share with you here (based on my prior efforts at TOD). Starting May 1, I have accepted an offer from Goldman Sachs to become a Managing Partner in a new energy and resource hedge fund where I’ll be one of three people responsible for security selection and risk management. Details, and the story of how I came to ‘see the light’ on resource depletion opportunities are below the fold. Basically I feel like a kid in a candy store.

Dear theoildrum.com readers. Many of you may have wondered about my absence here over the last 6 months or so. Suffice it to say that I’ve had a sea change of understanding about both our situation and on the opportunities it presents. As such, I’ve made some career change decisions, which Kyle and Gail are allowing me to share with you here (based on my prior efforts at TOD). Starting May 1, I have accepted an offer from Goldman Sachs to become a Managing Partner in a new energy and resource hedge fund where I’ll be one of three people responsible for security selection and risk management. Details, and the story of how I came to ‘see the light’ on resource depletion opportunities are below the fold. Basically I feel like a kid in a candy store.

OK – here it is in a nutshell – though I used to think the main problem with economic theory was that it ignored biology on the demand side and ecology on the supply side, I now see the reality is that neither biology nor ecology has incorporated enough economic theory. Basically, my efforts at falsification of positive economics even down to the day to day micro level have come up wanting. There are more people, more wealth, more stuff and more novelty in the human sphere of influence then ever before. After all humans are separate from and above all others in the animal kingdom and as such adhere to different rules. . The physics of money works – Malthus and Odum RIP. My friend George Gilder said it best:

‘The United States must overcome the materialistic fallacy the illusion that resources and capital are essentially things which can run out, rather than products of the human will and imagination which in freedom are inexhaustible.’ —George Gilder

And here are some quotes from a few other books Ive had the opportunity to read after spending less time on TOD that have had an influence on me:

‘The world can, in effect, get along without natural resources— Robert Solow – Nobel Prize winner in Economics – ‘The Economics of Resources or the Resources of Economics.’ Journal of Economic Literature 6 11. 1974.

and this book, which everyone at my school used to criticize, but I never had a chance to actually read the air-tight logic throughout the book until last Thanksgiving:

‘On average, human beings create more than they use in their lifetimes. It has to be so or we would be an extinct species. This process is, as the physicists say, an invariancy. It applies to all metals, all fuels, all food, all measures of human welfare. It applies in all countries. It applies in all times.’ Julian Simon and Norman Myers from “Scarcity or Abundance”? New York Norton. 1994. pp.133-134.

First, let me say that I’ve learned an amazing amount talking with energy and ecologically minded folk on this site – they (you) are truly a great bunch of people, though in the end, I think a bit misguided about resource depletion prospects. My key ‘aha’ moment was when I was in a conversation last year with new TOD contributor Art Berman discussing the amount of affordable unconventional natural gas in the US. He has (mostly convincingly) debunked the standard view that there are 100 years of natural gas remaining by hypothesizing that it will be extremely costly to produce. His, (and others) logic is then, that we won’t be able to procure this resource because consumers won’t be able to afford the $10, $15, $20 etc per mcf needed to pay the energy companies. But guess what – technology is getting better. But much more importantly, even were tech improvements to stagnate, we can print the money to pay for it.

Some other sea changes in my thinking are:

1. The ‘decreasing returns to complexity theory’ just falls down. a)we aren’t Roman or beavers and b)complexity is needed to grow. Ergo growth feeds complexity and vice versa in a virtuous cycle.

2. I used to think reserves were more relevant than resources in oil and gas until I realized that the resource has to be found first!. There is a sequence of events here. Duh.

3. Those that think we are headed for eventual currency reform due to debt overshoot are missing three fundamental truisms: a)more debt satisfies our evolved need for hierarchy, b)of the houses with mortgages in US, in aggregate they are almost at 100% loan to value right now, meaning people NEED more debt. Aand the zinger: c) new credit/dollars require very few natural resources – some paper (forestry product), ink and machinery, most of which is already built!

4. Those attached to abstractions of the ‘trillions of yet unborn humans and other species’ (I’m thinking of that moonbat commenter Greenish), and hypothetical damage to the earth via human activity are not grounded in the reality of mortgage and car payments, and vacations.

5. I used to think markets represented liquidity only and not predictors of future earnings stream but I now realize that liquidity creates its own wealth and earnings stream. And we have nearly unlimited liquidity! (I’m embarrassed that I missed this, but sometimes we get tunnel vision)

Even though I now fundamentally believe that resources, at least on the scale of my lifetime are unlimited, that doesn’t mean that I’ve not picked up some valuable things from the contributors here over the years, like cool stuff about phosphorous, algae and cows, and by living modestly during this time, I have reset my brain for a multiplicity of dopamine surges as I ratchet back into conspicuous consumption.

Basically I’ve spent 5 years learning really interesting stuff, attempting to share knowledge with other civically minded citizens of the world, and with what was in retrospect naive optimism tried to push our cultural metric away from Veblen goods and conspicuous consumption towards something more in balance with future solar flows. What a load of crap. All on a graduate stipend of $21,000 a year. Sure I’ve had more free time than ever before in my life, met all kinds of interesting people, learned how to grow and store food, and experienced nature at a level never available to those who work 50 hours a week, 50 weeks a year. But screw all that – given the opportunity cost of money think of everything I’ve missed.

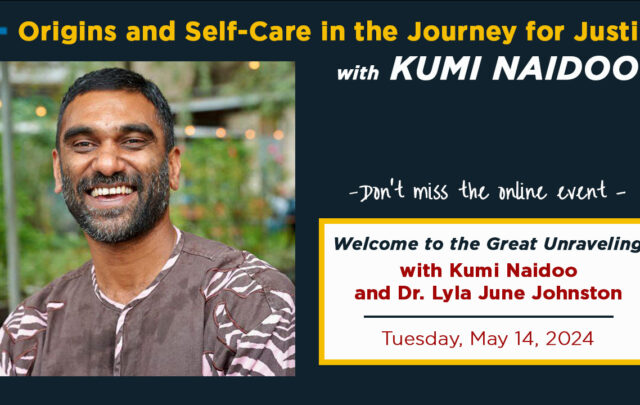

Graphic showing world electricity availability vs GDP, and my minimum acceptable threshold

I’ve decided that while there are plenty of resources, the distribution of those resources is likely to be increasingly uneven ((which is an opportunity if I ever saw one). I also like hot food, hot tubs and large wattage stereo systems, amongst other gadgetry, particularly if I know other people don’t have as much of this stuff. Really, let’s be honest, relative wealth is the very best kind since it’s the most satisfying. Ive figured out my minimum threshold of personal household kilowatt requirement and a graduate student salary just isn’t going to cut it. Irrespective of future electricity per capita, I’ve basically chosen the 93.5 percentile of electricity usage as ‘nates minimum’, which is part of the reason I’ve succumbed to Goldmans advances. And since I’m now aware of the hedonic ratchet, I have a plan for negotiating this level higher (in my contract) by bumping that percentile a bit each year.

Another reason is I want to leave a large nest egg to my progeny. (not for them, actually, but for the way it makes me feel now as I brag about it). Though I currently don’t have any children, my new ‘aha’ that we can print our way out of the limits to growth corner has kickstarted what I refer to as my ‘No condoms – No standards’ policy. So I’m guessing I will have over a dozen kids due in about 7-8 months. Mom get ready. Moreover, in an homage to the future of globalism I’m “outsourcing” my reproduction to the third world by awarding $500 grants for each genetically verified child conceived with the sperm I’ve sent to various third-world refrigeration facilities. In that way I intend to finally embrace the the agenda of my genes.

Back to the details of Cornucopia LLC. Here is what I can tell you right now:

Our investment thesis revolves around three core tenets:

1) the obvious fact that the environment falls outside of our market system, and therefore excess wealth derived from processing and packaging it, at least for those who have the balls to take it, is basically free.

1b) And God wants us to. (see Genesis 9, verses 1-2)

2) That growth and subsequent profits depends only in very small part on energy, but are primarily based on information, skill and human ambition. That human cleverness is the ultimate resource, requiring nothing but vacuum and time to create (almost) all conceivable value; and that matter and energy will always fall into line if we think about them cleverly enough. Since energy is a human concept, how can it be more fundamental than we are? This finally became clear to me.

3) The generation of financial capital (money) ushers in abundant social, human, natural and social capital as byproducts, but only to the ones near the source. Entropy does exist, just not in energy as I thought. As money is printed, you have to be close to its genesis to reap outsized rewards as the benefits it confers get watered down by the time it trickles into the economy at large.

As such my main trading strategy will be as follows:

A)Sell short energy stocks, especially the low cost producers.

B) Buy companies that use a lot of energy to both produce and transport their products (preferably consumer discretionary – the maximum power principle shows that they will have the advantage, of course)

C)Loan out our vault gold and silver and use the proceeds to buy Japanese Yen and Pound Sterling at 1% haircut.

D)Whenever possible, increase our gearing ratio.

Though this isn’t really public yet, my (new) colleagues were fortunate to hook me up with not only with great lawyers but great administrative/marketing people as well. We are going to securitize the future profits of Cornucopia LLC. Basically it will work like this. Given the background and expertise of everyone involved, on a ProForma basis we expect to make around 50% net in profits per year on an initial seed of $100 million. If we discount that income/trading stream back to the present, the net present value of our fund is about $500 million – we are offering people shares of this $500 million entity at a 20% discount! (total of $400 million). If you do the math, we those of on the inside are going to do very well. Hey, life is about reallocating resources away from others and the future towards oneself in the present- if you can’t beat em join em!

As a bone to you resource junkies, I am no water expert, but those of you crying wolf over looming water shortages might want to look at this image:

Here’s one little tidbit from our research team I can share with you. I’ve discovered that (over) 70% of our planets surface is water (H2O). Apparently it isn’t called the Blue Planet for no reason. I think those fretting over shale gas fraccing fluids water issues and large irrigation requirements for biofuels and solar thermal really should do more homework. (We’re currently looking for a way to short water (using leverage) for the fund as well).

In conclusion, someone once said ‘All the good things in life are free’. I think this is only partially true. A better statement would be ‘ the good things in life are free, but the great things cost money’. And, given my understanding of neural habituation to unexpected reward, one can’t easily stop at ‘great’, and ‘greater’ will certainly require more funds. As for the rest of you who remain unconvinced, best of luck growing those tomatoes in humanure and roping goats in the suburbs. I’ll think about you often. That’s what relative wealth is all about.

It’s good to be back…

Nate Hagens

Managing Partner

Cornucopia LLC