The recent deployment of missile launchers and jet fighters on Woody Island of the Paracel islands have put the spotlight on the South China Sea (SCS).

Fig 1: The 200 mile Economic Exclusion Zone claimed by China around Woody Island and the overlapping 108 nm range of the HQ-9 SAM system. Image via ISI. [Image Sat International] http://defense-update.com/20160218_woody_island_hq9.html

In this post, we focus on oil production around the SCS.

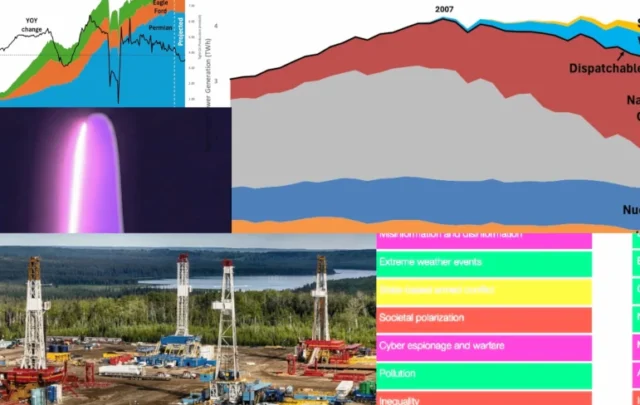

Oil production (crude and NGLs)

Fig 2: Black triangles denote country peaks, the red triangle shows the SCS peak

Oil production in 2015 was down around 14% from the peak in 2001.

Fig 3: China dominates all of South China Sea’s adjoining countries

Fig 4: China’s monthly production 2013-2015

Although production in 2015 was higher than in 2013 and 2014 it seems that production in the 4th quarter will not be much different from the previous years. A 100 kb/d difference is just 1% of China’s 2015 demand of 11.2 mb/d (IEA January Oil Market Report, p 57)

Chart of the Day: No turning back for China’s oil production

21/11/2015

China’s domestic oil production likely peaked this year and is about to enter a long-term structural decline, according to Nomura.

http://www.scmp.com/business/commodities/article/1881188/chart-day-no-turning-back-chinas-oil-production

Fig 5: Production of 3 oil majors in China

Oil imports

Fig 6: Thailand was always a net oil importer

Fig 7: Indonesia became a net importer of oil in 2003

Fig 8: Vietnam is a net oil importer since 2010

Fig 9: Malaysia turned into a net oil importer in 2011

Fig 10: China’s net oil imports have been growing at appr. 360 kb/d pa (last 10 years)

All together now

Brunei, China, Indonesia, Malaysia, Phillipines, Thailand, Vietnam

Fig 11: Homework for governments dreaming of Asian Century

Future oil production and demand

Fig 12: Oil production decline predicted in the World Energy Outlook 2015 (IEA)

Fig 13: Oil demand is expected to grow by 1.5% pa

2 years earlier, in the WEO 2013, the IEA warned of growing net oil imports in ASEAN countries.

Fig 14: ASEAN imports 75% of its oil in 2035

http://www.worldenergyoutlook.org/southeastasiaenergyoutlook/aseanreport_presentationtopress.pdf

The IEA’s production outlooks assume of course that sufficient investments are done in the oil and gas sector to moderate natural decline in existing fields. However:

Fig 15: Asia-Pacific CAPEX decreased by 14% between Q3 2015 and Q4 2014

http://www.drillingcontractor.org/pressures-mount-as-industry-goes-deep-into-survival-mode-37357

Forecast Shows More E&P Spending Cuts Worldwide

Fig 16: Asia-Pacific exploration & production spending is expected to drop by 21% in 2016

“Cowen & Co noted that companies used an average WTI oil price of $48.50/barrel for the survey. The annual forecast comes as the industry continues to endure the brutal consequences of an oversupplied market with oil prices now below $37/barrel.

Farther east, less spending from Petro China, Petronas and Sinopec are expected to contribute to the forecasted 21% spending drop in the Asia-Pacific region.”

http://www.epmag.com/forecast-shows-more-ep-spending-cuts-worldwide-833871

Conclusion

While the mainstream media are regularly reporting about artificial islands and militarization in the South China Sea, peaking oil production in this important region of the world and its economic impact is totally ignored. Not even the recent Australian Defence White Paper mentions, let alone deals with it. No wonder, therefore, that Australia makes itself even more vulnerable to oil supply disruptions by building yet more oil dependent infrastructure like the NorthConnex and WestConnex road tunnels in Sydney.

Related posts:

1/7/2015

Asia depends on Middle East for 66% of its oil imports

http://crudeoilpeak.info/asia-depends-on-middle-east-for-66-pct-of-its-oil-imports

10/6/2015

China’s offshore CNOOC started to peak in 2010

http://crudeoilpeak.info/chinas-offshore-cnooc-started-to-peak-in-2010

12/5/2014

10 years after peak oil in Vietnam: Asian Century sails into troubled waters in the South China Sea

http://crudeoilpeak.info/10-years-after-peak-oil-in-vietnam-asian-century-sails-into-troubled-waters-in-the-south-china-sea

18/6/2013

South East Asian oil producers – the widening gap between oil production and consumption

http://crudeoilpeak.info/south-east-asian-oil-producers-the-widening-gap-between-oil-production-and-consumption

10/9/2012

South East Asian oil peak in the rear view mirror