As the UK braces itself for yet another onslaught of gales and flooding, the Bristol Pound caught up with prominent local green economist Molly Scott-Cato for a chat. Barely a question in and Cato, who is also a Professor at the University of Roehampton and leads the Green Party’s list for this May’s European elections, has a very clear message: the floods are telling us a story, and we’d do well to listen.

As the UK braces itself for yet another onslaught of gales and flooding, the Bristol Pound caught up with prominent local green economist Molly Scott-Cato for a chat. Barely a question in and Cato, who is also a Professor at the University of Roehampton and leads the Green Party’s list for this May’s European elections, has a very clear message: the floods are telling us a story, and we’d do well to listen.

It’s a story about local resilience, economic empowerment and why, when it comes to money, we’re actually all just like fish. If you want to know why, you’d better read on…

What do you think of the local currency movement in the UK?

As an environmentalist there’s an awful lot you can get involved in that’s about protesting or campaigning, but it’s quite unusual to have something you can actually do which goes right to the heart of your everyday life and which makes a huge difference. Using a local currency is an example of just that.

We’re like fish which swim in water, and that’s what the monetary system is: it’s just there, we don’t see it. How many times every day do we spend money and so reinforce the global economy? But having a local currency is doing the opposite: we’re challenging the global economy and reinforcing the local economy. It’s really exciting to have the opportunity to do that.

That’s so great to hear you say that. Just how important do you think local currencies are in supporting local economies and communities?

Local resilience is key; and as a message I’ve been talking about my whole career, the recent flooding has particular importance to me as it really reinforces this point. I think we’ve grown used to just expecting food to come from the supermarket and not asking questions beyond that. It’s something which has left us really vulnerable because actually our food often comes from the other side of the world and is dependent on really complex supply chains. Extreme weather events show us just how unreliable these systems are: basic things can go wrong and the system can fail. The global trade system is also very energy intensive, so even if it was reliable we can’t afford the ongoing carbon cost.

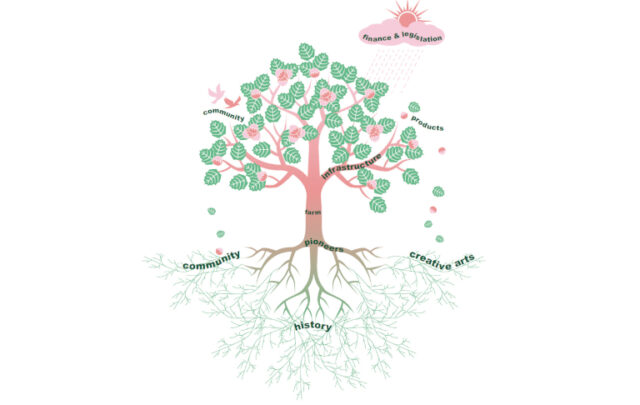

Here in the South West we have extremely fertile soil: meaning we could, and should, be providing for our own needs. The Bristol Pound as a local currency really brings all that together because if you have a local economy you need a currency to facilitate exchanges. If you have a local currency then you encourage people to buy from local shops, and then for those local shops to buy from local suppliers – instead of getting caught up in global supply chains.

What you’re talking about of course is the local ‘multiplier effect’…

Yes, the local multiplier is important in shaping how we shop. But what’s even more important is how the multiplier effect can encourage not just more local spending, but more primary production. There’s food growing in Bristol now and I think that’s what we need to be expanding – and a local currency can encourage that. Once supply chains become extended they become energy intensive and enable middle-men to extract value out of the supply chain. As a system this is wasteful, and it also creates inequality. That globalised system is my target really, and why I trained to become an economist so I could work towards finding better ways of doing things.

You’ve written a lot about the democratisation of money: to what extent do you think the success of schemes such as the Bristol Pound and campaigns like Positive Money indicate a public appetite for change?

It seems obvious to me that if you want to have a democratic society you need to have a money supply which is under democratic control. Continuing to have a system where an elite minority has a huge influence over economic policy is incompatible with that. But that’s a very threatening argument! – in a similar way to properly addressing challenges like climate change. As a result I’m afraid to say that debate just doesn’t really happen in our mainstream media.

However, I think the financial crisis really shook people up. If we go back to the analogy of the fish you see the possibility that your water has been all drained away – and suddenly you realise, there was water there and you didn’t understand how that worked. When I first started looking into all this some 10 or 15 years ago people didn’t want to talk about these issues, but since 2008 people are really thinking about it. They associate their welfare with money, and realise now that it’s not secure, so are really paying attention now – and that’s a huge opportunity.

What would you like to see change on a national level, and how can local schemes contribute to the debate?

The issue of the banks, and the security of their operations, has simply not been addressed because of the power of the bank lobby. So we’re still in just as insecure a position as we were. Plus, the cost of bailing out the banks has led us into this awful austerity politics: so we’re all paying a huge social price for that.

The whole question of money creation has still not really been raised, and it’s that part of the argument which now really needs have attention drawn to it. This is where schemes such as local currencies can really help to raise awareness of those wider issues – because people who use the Bristol Pound will start to ask those questions. Having a local currency is a great way of learning what your economic motivations and priorities are.

Are there any other monetary innovations either at home or abroad which have particularly inspired you?

Well, obviously the Chiemgauer is very impressive [one of the most successful local currencies in the world – click to read one of our previous blogs about it]. When we launched the Stroud Pound we copied the Chiemgauer because it’s just been so successful and influential. They’ve managed to effectively use the currency to build up and become a bank. They’re now able to lend to local businesses and are now a powerhouse in their local economy.

Local currency movements in South America are also very interesting. What you notice there is that people will always use the best available money: we have a so-called strong currency here, but in Argentina a local currency has a lot more relevance. Local development banks in South America are even using local currencies to multiply the amount of money people in need are getting from the government. Banco Palmas in Brazil is a good example of that.

To what extent do you think innovations such as Bitcoin have a role to play in a more democratic and socially useful monetary system?

Bitcoin is an interesting thing, but I don’t think it makes our money supply any more democratic: it’s not clear to me who runs it and where the value is extracted and that makes me nervous. The power systems with Bitcoin are invisible, and I’m also always asking questions about the extent to which the internet is democratic, and I don’t think it is. Some people have vastly more power over things which happen on the internet than others.

Bitcoin is also not local: it doesn’t build relationships. To me the social exchange is as important as the economic exchange and on this score Bitcoin is empty. Local currencies, on the other hand, will promote local exchange and relationships. And to me, that’s of crucial importance when redesigning our money supply.

Huge thanks for taking the time to talk to us Molly!

To read one of our previous blogs on Bitcoin click here. Read more of Molly Scott-Cato’s musings at her blog or you can find her on Twitter here.

Photo: Transition Bath