NOTE: Images in this archived article have been removed.

Off-shore oil rig image via *Psycho Delia*/flickr.

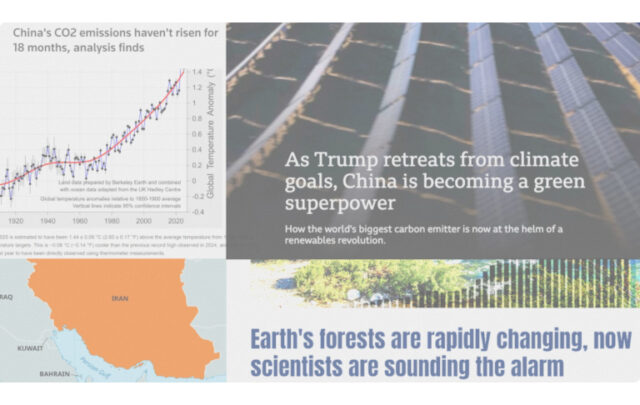

Three things you shouldn’t miss this week

- Global riot epidemic due to demise of cheap fossil fuels – From South America to South Asia, a new age of unrest unfolds as industrial civilisation transitions to post-carbon reality.

- UK oil and gas production in terminal decline? Offshore production by field:

http://crudeoilpeak.info/uk-peak

- The Energy Transition Tipping Point is Here – The economic foundations for fossil fuel investment collapse as the business case for renewables builds.

Diplomatic efforts are underway to diffuse tensions between Russia and the West following the overthrow of Ukrainian President Yanukovych. Should tensions escalate, one risk is the disruption of gas supplies from Russia to Europe via the Ukraine.

A standoff between Russia and Ukraine following the Orange Revolution saw gas supplies disrupted in both January 2006 and early 2009. Europe is now better placed to weather such a storm thanks to improved gas storage facilities, the new Nord Stream pipeline from Russia to Germany and an unusually mild winter. But Moscow’s recent threat to suspend its 30% gas price discount to Ukraine could still have major political consequences given the country’s perilous financial position and political divisions.

In the UK, oil and gas moved centre stage last week. With September’s referendum on Scottish independence fast approaching, both David Cameron and Alex Salmond arrived in and around Aberdeen with their cabinets in tow to talk up their readiness to boost offshore oil and gas production.

The harsh reality is that both sides are fighting the wrong battle, as our chart of the week clearly illustrates: UK oil and gas production is in terminal decline and has been since the beginning of the millennium. A clear plan to transition away from fossil fuels could be a vote-winner.

Challenges to the oil and gas business model aren’t limited to the UK, as a

recent presentation by Steven Kopits of Douglas Westwood demonstrates. In short, despite growing global demand for their products, the major oil companies are struggling to maintain supply, and new supply from unconventional resources is coming at a high cost. Record capital expenditure has failed to break this cycle and companies are now cutting capital spending and divesting to keep shareholders happy – the most recent example is BP’s announcement that it is to shed its US shale business.

Fossil fuel giants are increasingly on the back foot. It’s high time for an energy policy which reflects the real changes going on in the world.

Related Reports and commentary