What should good societies do when a wealthy few reap enormous financial windfalls during a global pandemic?

While millions lost their lives, livelihoods, health and wealth, the world’s billionaires and super-rich prospered. According to research from Americans for TaxFairness and the Institute for Policy Studies, between 18 March 2020 and 19 February 2021, the combined wealth of US billionaires increased by $1.3trn, a 44.6% increase in the space of just 48 weeks.

The concentration of wealth is staggering. There are now 661 billionaires in the US, with a total wealth of $4.26trn as of 19 February 2021, up from $2.9trn on 18 March 2020, nearly a year earlier. For perspective, the combined wealth of the bottom half of all US households, 165 million people, is $2.4trn, according to the Federal Reserve.

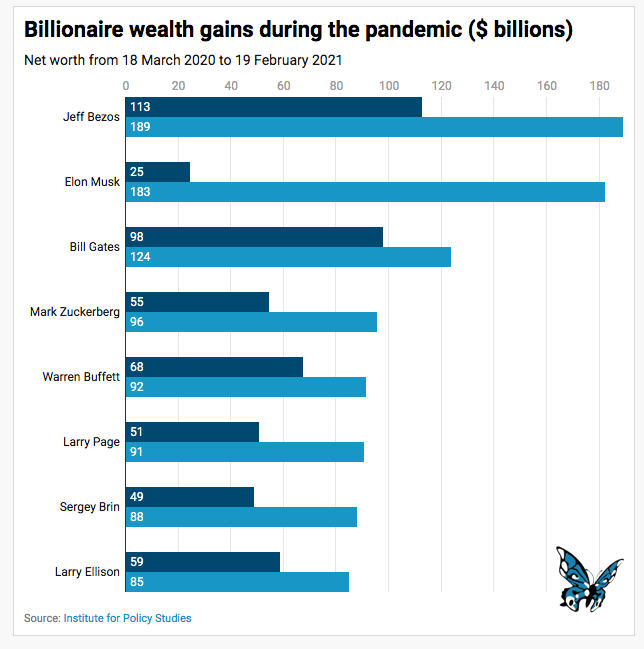

Elon Musk’s wealth grew by an astounding $157bn, from $24.6bn on 18 March 2020 to $182bn on 19 February 2021, a nearly seven-fold increase, boosted by the rapid increase in the value of Tesla stock.

Jeff Bezos’s wealth grew from $113bn to $189bn over the same period, an increase of almost 60%.

Mark Zuckerberg’s wealth grew from $54.7bn to $95.7bn, fueled by his ownership of Facebook.

Dan Gilbert, chairman of Quicken Loans, saw his wealth skyrocket by 559%, from $6.5bn in March 2020 to $42.8bn on 19 February 2021.

The combined wealth of US billionaires increased by 44.6% between March 2020 and February 2021 | Data from the Institute of Policy Studies

These are democracy-distorting levels of concentrated wealth and power. And many of these billionaires control powerful companies with the ability, especially during the pandemic, to consolidate their market share and monopoly power over large sections of the US and global economy. Amazon, Walmart and Target have all benefited from having their main-street competition effectively shuttered under the artificial economic conditions of the pandemic.

The wealthy do not always benefit during economic adversity. In the aftermath of the 2008 recession, US billionaires saw their fortunes decline along with everyone else’s. It wasn’t until almost four years later, in September 2012, that the total wealth of the Forbes 400 exceeded its pre-2008 recession levels.

While some increases in billionaire assets mirror the overall rise in stock markets, the largest gains reflect their ownership stakes in powerful companies that have taken advantage of temporary monopoly and home isolation conditions created by the pandemic.

Online retail, restaurant and food delivery apps, telemedicine, big pharma, and video-conferencing have all reaped windfalls from the unusual pandemic economy. Of the roughly 56 new billionaires that emerged over 2020, many are associated with initial public offerings at companies like Doordash, AirBnB and Snowflake.

The US’s 661 billionaires have a total wealth of $4.26trn. The total wealth of the bottom 50% of all households, 165 million people, is $2.4trn

These unseemly inequalities are the context for a debate over who should pay for trillion-dollar COVID-recovery packages. While politicians of all persuasions have largely avoided talking about how to pay for the trillions in deficit spending over 2020, the moment has now arrived.

Around the world, countries are considering wealth taxes on surging billionaire assets as one source. Argentina and Bolivia are both considering wealth taxes to help pay for economic recovery.

Times of war and crisis in the US have historically led to the institution of more progressive tax systems, including the “conscription of wealth” to pay the bills. In 1862, the US established an inheritance tax to help pay for the Civil War. Levies on inheritances and estates appeared during the Spanish American War and First World War, finally being codified in 1916 with permanent federal income and estate taxes.

In July 2020, several US Senators introduced the Make Billionaires Pay Act to levy a one-time 60% pandemic wealth tax on billionaire gains over 2020. By one estimate, this would have raised $420bn for a health care provision. Several states, including California and Washington state, have legislation pending to institute a wealth tax and make their state estate taxes more progressive, with higher rates on billionaires.

This week, Senator Elizabeth Warren will introduce an updated version of her wealth tax proposal. Warren’s initial proposal was an annual wealth tax on households with wealth starting at $50m, roughly the 100,000 wealthiest households in the U.S. The 2% annual levy would increase to 6% on every dollar of net worth above $1bn. The proposal would raise almost $4trn over the next ten years.

A tax that exempts 99.9% of taxpayers yet raises substantial revenue from billionaires is good politics and policy. While members of Congress might be divided over a wealth tax, polls over the past two years indicate wide public support for taxing the wealthy.

An annual tax on wealth will require a new set of implementation rules. In the meantime, Congress can move quickly to restore progressivity to the US tax code, a system that has seen tax rates paid by billionaires erode over the last half-century.

One proposal is to institute a millionaire surtax, a 10% income tax surcharge on incomes over $3m, whether from capital or wages. This would raise $660bn over the next decade entirely from households in the top 0.1% – and move us closer to a fairer system that eliminates the preferential tax treatment of income from capital over income from wages and work.

None of these proposals will succeed unless the US shuts down the tax loopholes, offshore tax havens, and dynasty trusts that enable the very wealthy to hide their wealth at a dizzying pace.

Taxing wealth to pay for COVID relief and economic recovery initiatives is only fair during a pandemic where lower-income and people of color have been hit hardest. But a tax on wealth would also help protect democracy from the “tyranny of a plutocracy” that worried President Theodore Roosevelt at the beginning of the last century.

Today’s massive concentrations of wealth and power are disruptive to democratic institutions, social cohesion, and economic stability for all. It’s time for a billionaire wealth tax.

Teaser photo credit: By Atwater Village Newbie – Spelling Manor, Holmby Hills, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=7614947