these were so squint of mind. As in the handling of their wealth to use. No moderation – none in either kind. (Dante’s Inferno)

I revisited Charles Dickens’ Victorian ‘Christmas Carol’ several weeks ago on modern Christmas Day. I gathered similar tales of woe about inequality and poverty between the English Victorian Age and the 21st Century, although the idea of the sin of greed in Charles Dickens’ Christmas Carol is probably outdated. Dickens’ story embodies the nature of contemporary economic problems which we face, in terms of interest, debt traps and the meaning of the financial economy for both the haves and the have-nots. If we want to understand the growing income and wealth inequality between them, which is not an accident, we have to examine the way society is organised by looking at the history of the banking system.

The development of the banking system was related to religious values and sovereign debts. Originally, the Catholic Church, as well as other Abrahamic faiths such as Islam and, within the confined community context (monetary interaction between Jewish people, not between a Jew and a non-Jew) Judaism, forbid usury or the act of money lending with interest at any rates. People in the ancient and medieval periods considered it an act of economic exploitation and injustice by the privileged against the poor by using these financial instruments. It was (and in the Islamic World still ‘is’) economic exploitation because the wealthy take advantage of the desperate condition of the poor. It was injustice because the acts often make the poor to be trapped into lifelong debts without debt forgiveness. ‘Debt’ was a concept associated with slavery (serfdom). Mortgage meant ‘death pledge’. The religious ban restrained the expansion of money lending activities in the Christian world up to around the 13th and 14th centuries, when Italian banks such as the Medici Bank were created and started to influence other parts of Europe financially as well as culturally.

Christian attitudes towards usury or interest, which Scrooge’s business was involved in, have changed over time after the Italian financial innovations. These included the Medici’s bill of exchange, Popes from the banker family such as Pope Leo X (1475-1521) and Pope Clement VII (1478-1534), the sale of indulgences which promised remission from punishment for sin, and more importantly the Reformation. John Calvin proposed the permitting of money lending with low interest rates, which led to the establishment of Swiss Banks. The definition of ‘usury’ changed from money lending at any rate of interest to that at ‘high’ interest rates. Many Protestant countries accepted money lending with low interest rates by the time of the 16th Century. It was Victorian England which abolished all restrictions on money lending, which therefore allowed money lenders to legitimately charge high interest rates (1845). So Scrooges’ business could charge high interests too if he had wanted. Money lending was not, however, probably a respectable occupation in Scrooge’s Victorian era (1837-1901), which is quite in contrast to the present period.

Money lending was probably a profitable business in the Victorian era because of the poor economic conditions of the working class which were derived from low wages and irregular incomes. The Enclosures were also responsible for their desperate financial conditions because it made small landowners jobless and landless or in contemporary terms, the homeless. Those populations moved to urban areas to find jobs, which were often low waged.

The interest rate in the 21st Century is understood not from a religious viewpoint, but from that of consumer protection. Although anti-usury laws differ by country, many countries regulate the level of interest by placing interest caps. The US has anti-usury laws at both Federal and State levels but the maximum interest rates depend upon individual US States. The dual system, however, seems not to work properly as it pushes down financially desperate population into debt traps. Various short-term or emergency loans such as payday loans and card loans with high interest rates currently operate across the US. Regarding credit cards, State anti-usury laws are ineffective because higher interest rates in deregulated states such as Delaware (no limit where the loan exceeds $100,000) and South Dakota (no regulation) can be exported to other US States according to a 1978 US Supreme Court decision in Marquette National Bank v. First of Omaha Corp. The consumer-protection systems have apparently broken. The underlying problems in the contemporary US, low wages and unemployment, are similar to the British Victorian era as well as the US Gilded Age (1870s-1900).

Besides private debts, the development of the financial system was also associated with sovereign or Kings’ debts. For instance, the English Financial Revolution, in which William III introduced the Dutch financial system shortly after the Glorious Revolution (1688), made it possible for England to pay for an expensive war with France by issuing first bonds (the public debt system) and establishing the Bank of England (1694). Since then, sovereign debts and wars have often been great opportunities for financiers to make fortunes by gaining interest earnings.

The current financial system is quite primitive, if not cunning and sinister. It serves oligarchy (creditors) at the expense of non-executive employees (debtors). Society overflows with huge private and sovereign debts. The financial sector is profitable as long as people borrow money (e.g. mortgage and card loans) and repay with interest, in particular with higher rates. Low wages, expensive housing and problematic government tax revenues are the best conditions for financiers to make profits as long as they repay.

Are there any solutions for the current debt inflated society? Some may propose strict usury laws to protect consumers, which would be useful. It is, however, not sufficient to make the personal finance of low-income families healthy. What low-income families need is proper incomes as well as a roof over their heads. The current problem is the absence of the fair profit distribution mechanism between executives (executives’ salaries, bonuses and dividends) and employees (employee payments and bonuses). Minimum wage amounts are too low. This has made it possible for executives to gain immense incomes at the expense of employees’ living standards. Shareholder primacy and stock buybacks in the stock market have also worked to expand the wealth and incomes of the affluent. How to allocate a piece of the entire profit pie has been left to the executives’ moral conscience, which has never been a solution.

The chains of greed now circulate all over the world. Another global financial crisis is on the horizon. It is highly likely there will be no bailout this time, ending up with the loss of pensions, insurance and savings. As Tiny Tim’s fate was closely linked to Scrooge’s, two different classes are in the same case, both sleepwalking to the moment when they are swallowed by the financial Leviathan.

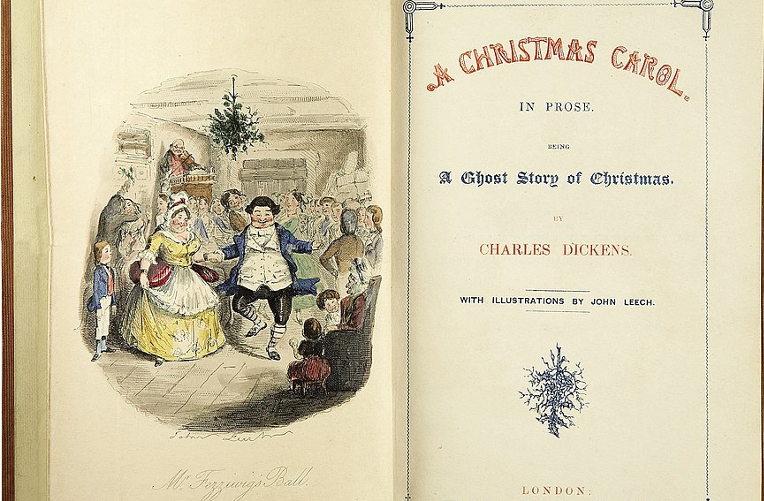

Teaser photo credit: By John Leech – http://historical.ha.com/common/view_item.php?Sale_No=683&Lot_No=57424&type=&ic=, Public Domain, https://commons.wikimedia.org/w/index.php?curid=4581698