September is an equinoctial month—a time of momentary balance, instability, and change. Day and night are of equal length; however, the rate of change in the relative lengths of day and night is at its peak.

It’s been an unusually busy and stressful month for me personally. Leonardo Dicaprio’s enviro-doc “11th Hour” hit the theaters, featuring yours truly on-screen for a few seconds (though the producer and director decided against including a mention of Peak Oil). Early in September I gave a presentation at the UN at the behest of two organic agriculture organizations (the Soil Association of Britain and the Shumei Foundation of Japan). On Thursday the 13th, a CNN Money reporter called wanting information about Peak Oil; his story appeared the next day. The very first copies of my new book, Peak Everything, shipped during the last week of the month. A few days ago a Korean TV crew stopped by and filmed me at home for a three-part documentary to air in November. And a family emergency (aging parent) sent me off to the Midwest for a week. As the saying goes, there’s no rest for the wicked.

The month was no less eventful for the rest of the world—though of course the scale of significance of the following items is approximately 6.7 billion times greater than for the preceding ones.

Maybe the best place to start is with a general comment. It’s getting pretty damn obvious that the world is sliding head-first into the abyss at an accelerating rate, with most Americans as oblivious as ever. The latest indication of impending doom is a festering credit crunch brought on by the inevitable puncturing of a bubble puffed up over the past few years through the issuance of thousands of patently idiotic subprime, adjustable-rate, and interest-only mortgage loans.

The deeper story is that this is just the last of a series of bubbles that the US Federal Reserve has inflated in order to sustain for as long as was humanly possible a fundamentally unsound national financial condition.

As I explained in Chapter 2 of The Party’s Over, the US got rich exploiting its own resources and labor. Its most valuable resource—oil—went into decline forty years ago; since then, we Americans have tried to stay rich by exploiting other nations’ labor and resources, using leveraged trade rules, dollar hegemony, and military threats. All this time, we congratulated ourselves: we were living in a post-industrial information economy; they were doing the dreary, obsolete work of actually making things. They sweated and saved; it was up to us to spend and borrow. We served an indispensable function in the global economy as the consumer of last resort, as the engine of new debt creation (more debt equals more money in circulation—i.e., more GDP growth), and as the global cop keeping order in an unruly world (while also sneaking donuts and taking bribes). The Chinese burned their coal and poisoned their workers and environment to make our stuff, enabling us to enjoy a cleaner environment by keeping our coal in the ground, while they loaned us the money to buy cheap Chinese stuff with. Such a deal!

Life in bubble world was grand while it lasted. First there was the Third World debt bubble of the ’80s; then came the tech bubbles of the ’90s; and finally the real estate bubble of the ’00s. Along the way, Wall Street hoped for a little extra hot air from the privatization of Social Security, but even Americans weren’t stupid enough to sign onto that particular leveraged buyout. All during this time, suburbanites got used to having more gadgets and bigger cars and houses, even if they couldn’t actually afford them.

But now we’re at the end of the line. At last the rest of the world is coming to realize that it doesn’t really need Americans: the Chinese can consume, too, after all. And the Asians can’t really justify loaning us more money; we’re not going to pay it back—or if we do, it will be in devalued dollars. But those loans can also be looked at as investments: other nations have in effect bought US assets, which means that the wealth created from those assets will flow to the new overseas owners, not to Americans. What’s left to buy—other than a lot of soon-to-be-foreclosed real estate? And how much wealth will those assets produce once the bubble deflates?

It’s also clear now that there are alternatives to the dollar, including the euro, the yen, and the yuan. Not that the dollar won’t be missed; when it tanks, there will be as many financial casualties in Mumbai as Manhattan. But currency traders are clearly heading for the exits, and the last one out gets the booby prize—a bag of wooden nickels.

Yes, the rest of the world still must fear America’s awesome weapons of mass destruction: this mighty nation can certainly create an unholy mess when it means to, as it is demonstrating in Mesopotamia. But that doesn’t mean that other nations actually have to obey it any more. The US can bomb to smithereens any country it chooses, but it can’t always count on forcing that country to hand over its resources at gunpoint.

The dollar is hitting record lows. Gold and silver are hot commodities—always a bad sign for the reigning paper currency. There are rumors of possible bank failures (following a run on one British bank). If the Federal Reserve tries to solve the liquidity crisis by lowering interest rates, that just worsens inflation and exacerbates the dollar’s problems. If the Fed raises rates to prop up the dollar, that forces the banks and hedge funds to confront their mountains of worthless paper and leads ultimately to defaults, bank runs, and bank failures. Clearly the Fed fears the latter scenario more than the former, so by lowering interest rates this month it effectively pulled the plug on the dollar. The Saudis are now preparing to de-link their economy from the US currency, while China is quietly selling off dollar-denominated assets. One way or another, Americans are going to soon see a rapid decline in their real standard of living.

Of course, another big event this month was oil’s nose-bleed ascent to record-high prices, over $82US per barrel. Part of the price hike resulted from the dollar’s weakness, but—as Goldman Sachs has pointed out—the main reason was simply that demand is up while supply is down. The May 2005 peak for the rate of production of regular crude and the July 2006 peak for all liquids are still holding. It may be that the technical maximum global rate of flow for liquid fuels is still a couple of years away, but in effect the peak is here now.

As for Iran, “all options” are still on the table, and the pretext for a broad-scale air attack is apparently being patiently laid. Bush has vowed that he will not leave office with the Iran question unresolved, and France’s new neocon leaders are running defense for Bush/Cheney, calling for “the most severe sanctions possible” and for war if those “don’t work.” Meanwhile, when Tehran actually complies with the International Atomic Energy Agency’s requests, this is viewed as a provocation. This month, Newsweek revealed that Vice President Dick Cheney at one point considered asking Israel to launch air strikes on an Iranian nuclear site, so as to provoke Iran to lash out, thus giving Washington a pretext for more extensive attacks (a scenario I discussed in MuseLetter for April 2007, “Iran: We Will Know Soon”). Iranian President Ahmedinejad’s appearances in New York (at the UN and Columbia University) seemed only to give the US media an opportunity to whip up further anti-Iranian public sentiment, while the Senate’s passage of the Lieberman-Kyl amendment (which Hilary Clinton supported) provided a stamp of approval for any future military actions by the current administration.

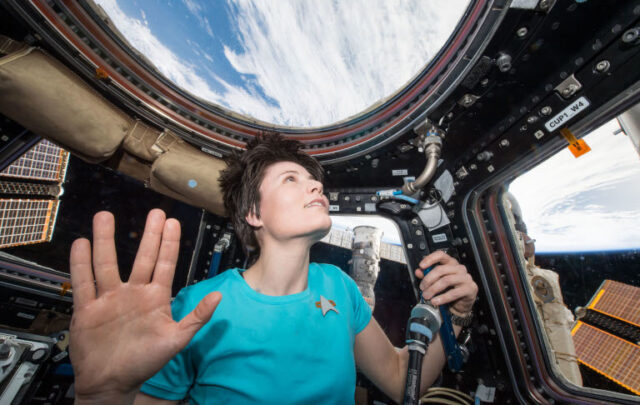

But surely the single most important event of the month was the revelation that arctic sea ice is melting faster than even the most dire forecasts had predicted. This is significant because it shows the power of reinforcing feedback loops: as sunlight-reflecting ice melts, it leaves dark water in its place—which absorbs more heat, causing more ice to melt, and so on. This year’s minimum extent of ice was about one million square miles (as of September 16); the previous record low was 1.5 million in 2005. The rate of melting this year was 10 times the recent annual average. This month the Northwest Passage was ice-free for the first time in untold millennia. At this rate, the north polar region could be ice-free in summer by 2015.

Altogether, it was an extraordinary 30 days. Yet so far there’s been no instantaneous economic implosion, and there’s not much blood in the streets (except perhaps in Myanmar), and so the mainstream media can safely focus on the truly vital issues like O.J. Simpson’s current legal scrapes and Britney Spears’s performance at the MTV awards.

Many writers who discuss the sort of stuff that interests me (“reality” I think it’s called) wrap the unutterable sadness of it all in a crisp cellophane of cynicism. I’m guilty of that, too, from time to time—certainly in this little monthly summary. How else to make it somehow bearable?